Is the $300 Direct Deposit for Child Tax Credit 2024?

Hey there, families! If you’re wondering about the $300 direct deposit for the Child Tax Credit in 2024, you’ve come to the right place. We’ve gathered all the juicy details just for you. 🥳

What Exactly is the Child Tax Credit?

The Child Tax Credit (CTC) is a tax benefit offered to American families with qualifying children. It’s designed to help parents cover the costs of raising kids. In 2021, the American Rescue Plan made some significant changes to this credit, including increasing the amount and offering monthly payments!

Will There Be $300 Monthly Payments in 2024?

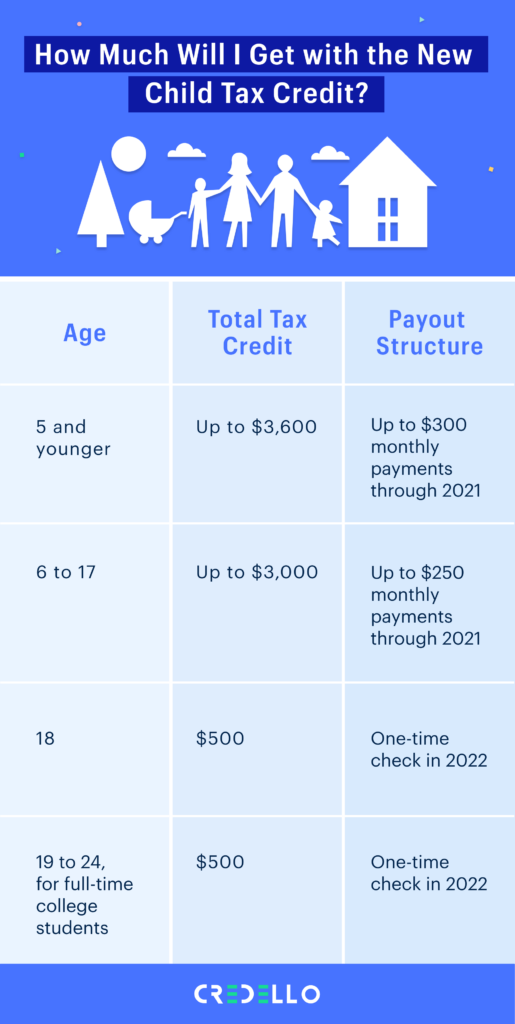

Here’s the scoop: As of now, there’s been no official word from the IRS on whether the $300 monthly payments will continue into 2024. The payments of up to $300 per child under the age of 6 and $250 per child aged 6-17 were part of the expanded Child Tax Credit for 2021. The increase and monthly distribution were meant to provide immediate financial relief to families during the COVID-19 pandemic.

So, What Can We Expect for 2024?

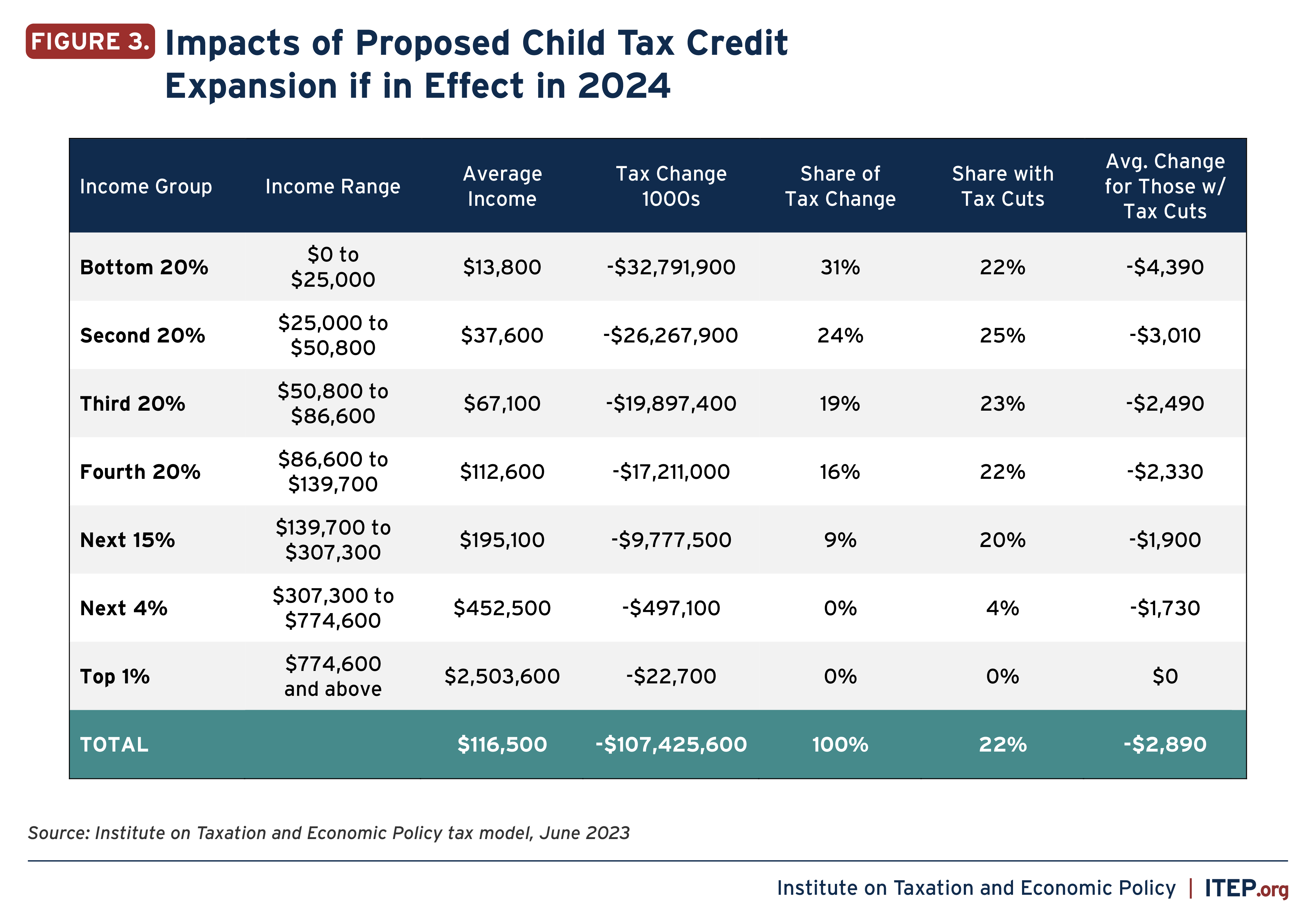

As of 2023, there’s no confirmation that these monthly payments will continue at the same rate in 2024. It’s crucial to stay updated by checking the IRS website or subscribing to their news updates. However, it’s possible that Congress could pass new legislation extending these benefits. 🤞

How Can You Receive These Payments?

Updating Your Direct Deposit Information

If the payments do continue, here’s what you need to know about receiving them via direct deposit:

- Visit the IRS Child Tax Credit Update Portal on IRS.gov.

- Confirm your eligibility for the payments.

- Check and update your bank account information. Make sure your details are accurate to ensure you receive payments promptly.

- If you prefer receiving the payments by check, note that you can switch to direct deposit anytime to avoid delays and the risk of lost or stolen checks.

What If You Want to Stop Payments?

Not everyone prefers monthly payments. If you’d rather receive the full credit when you file your tax return, you can opt-out using the same portal. This choice might be beneficial if your income changes significantly, or if you no longer qualify for the credit.

Key Takeaways

- As of now, there’s no confirmation that $300 monthly payments for the Child Tax Credit will continue in 2024.

- Stay updated by checking the IRS’s official announcements.

- You can manage your payment preferences and update your direct deposit information through the IRS Child Tax Credit Update Portal.

Stay tuned for more updates! And don’t forget to keep an eye on your eligibility and the latest IRS news to ensure you get the benefits your family deserves. 🌟

Have more questions? Drop them in the comments below, and we’ll do our best to get the answers for you!

Cheers to financial well-being! 🥂