What is Earned Income Credit (EIC)? Discover All You Need to Know!

Hey there, tax payers! If you’ve been wondering about the Earned Income Credit (EIC), you’ve come to the right place. Let’s break down everything you need to know about it in a fun and easy-to-understand way. Shall we dive in?

1. What is Earned Income Credit (EIC)?

Earned Income Credit, also known as the Earned Income Tax Credit (EITC), is a special tax benefit for low to moderate-income workers and families. It’s designed to put more cash back in your pocket, helping you reduce the taxes you owe or even increase your refund. Sounds like a win-win, right?

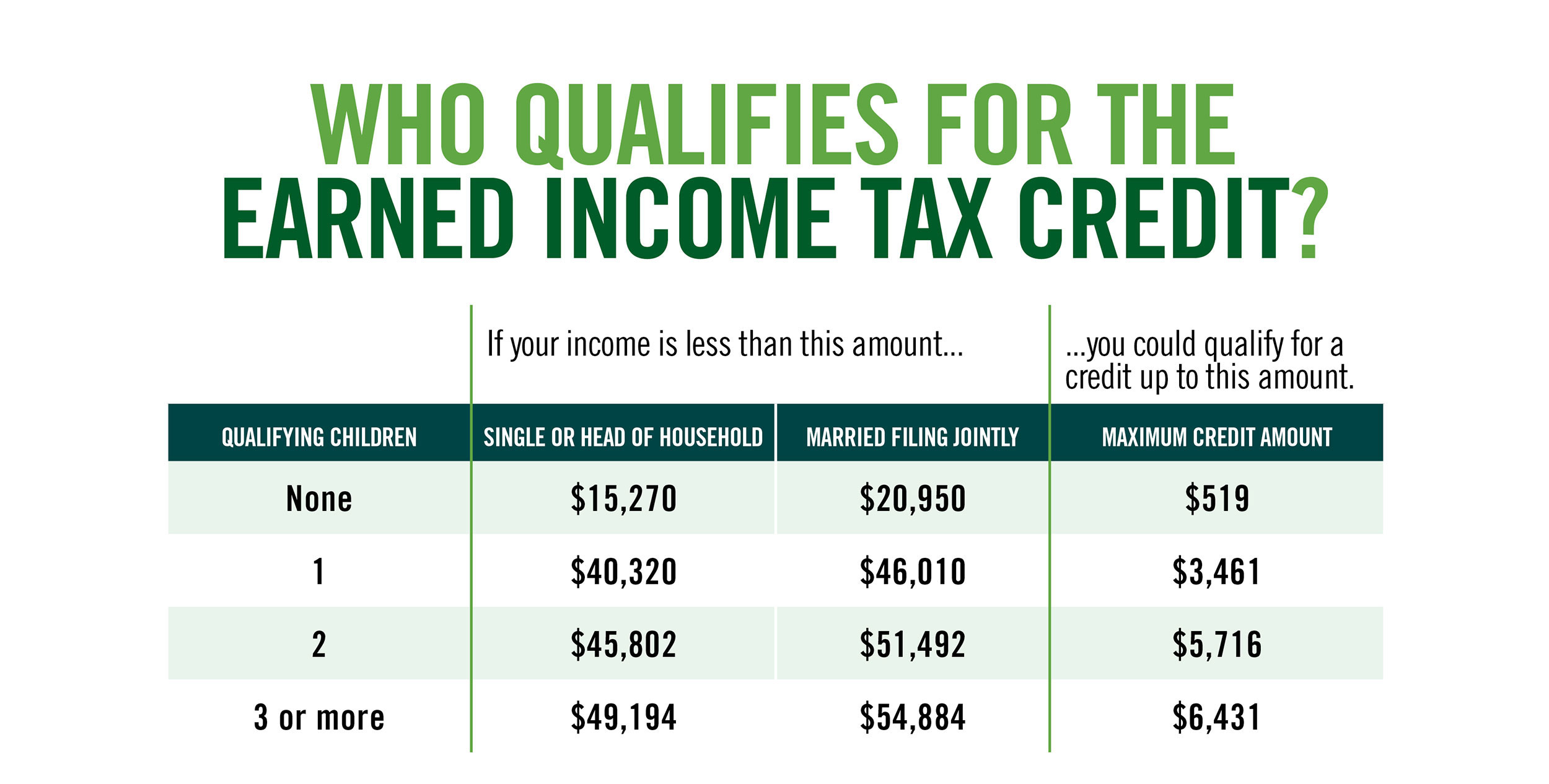

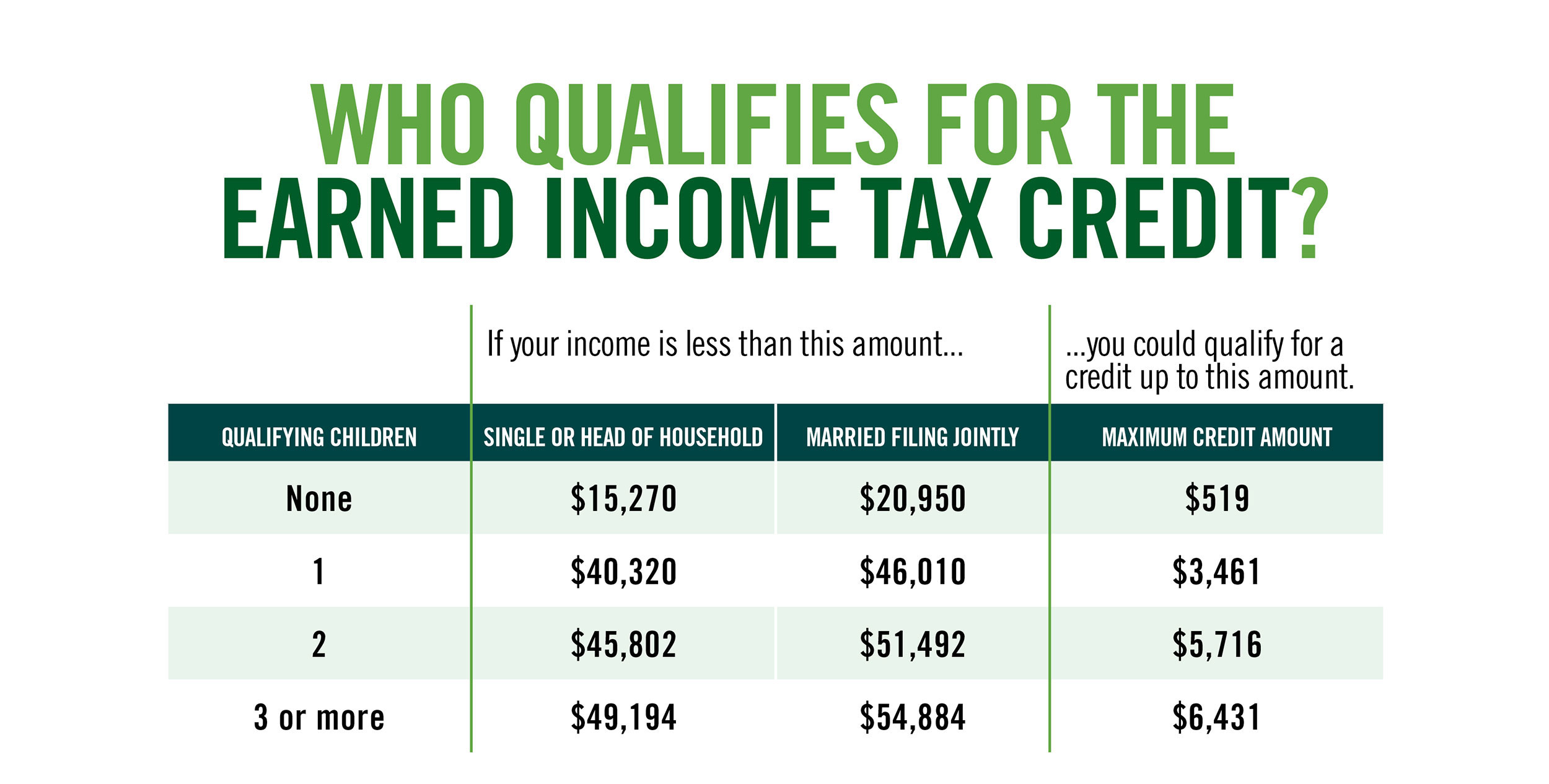

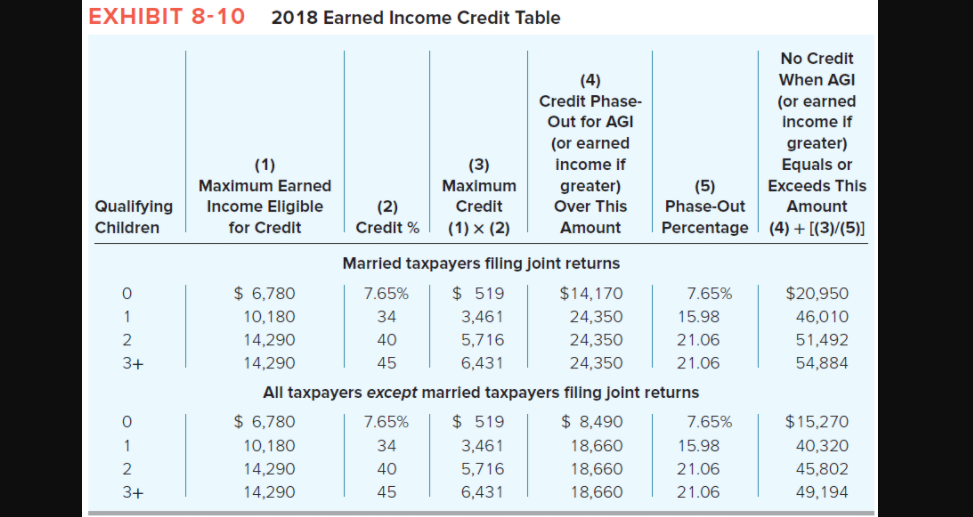

2. Who Qualifies for EIC?

Basic Qualifying Rules

- You must have worked and earned income under $63,398.

- Your investment income should be below $11,000 for the tax year 2023.

- Have a valid Social Security number by the due date of your 2023 return (including extensions).

- Be a U.S. citizen or a resident alien all year.

- Not file Form 2555, Foreign Earned Income.

- Meet certain rules if you are separated from your spouse and not filing a joint tax return.

For more detailed information, you can visit the official IRS page on EITC.

3. Special Qualifying Rules

The EITC also has special rules for certain groups:

- Military members

- Clergy members

- Taxpayers and their relatives with disabilities

Need to check if you qualify? Use the EITC Qualification Assistant.

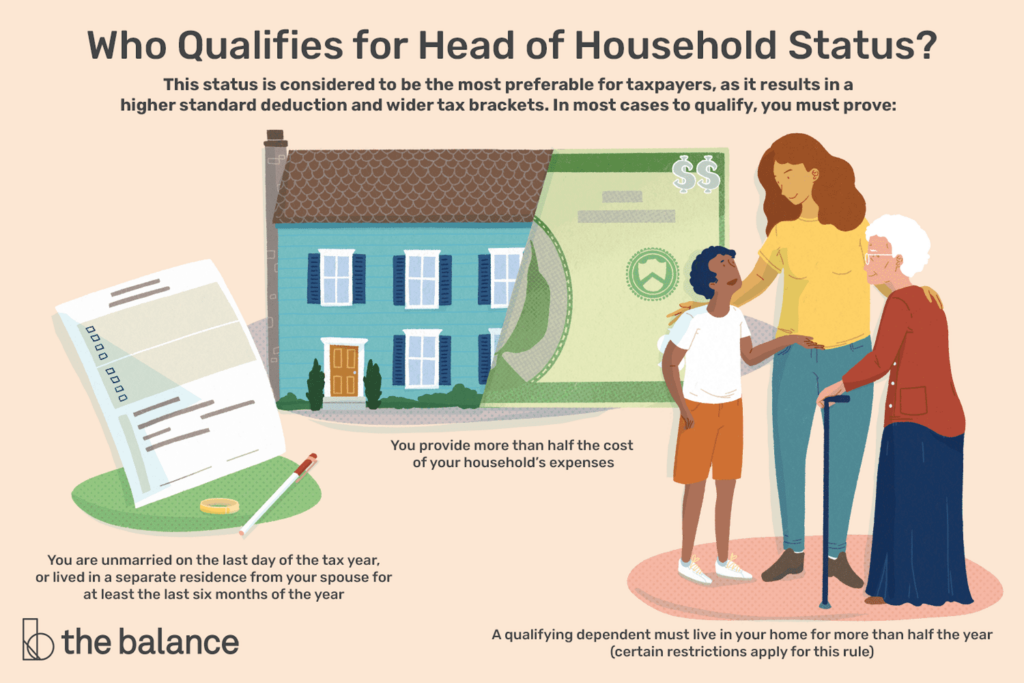

4. Filing Statuses That Qualify

In 2023, these filing statuses qualify for the EITC:

- Married filing jointly

- Head of household

- Qualifying surviving spouse

- Single

- Married filing separately (under certain conditions)

5. EIC Without a Qualifying Child

Good news! You may still be eligible for EIC even if you don’t have a qualifying child. To claim the EITC without a qualifying child, you must:

- Meet the basic qualifying rules

- Have your main home in the United States for more than half the tax year

- Not be claimed as a qualifying child on someone else’s tax return

- Be at least age 25 but under age 65

6. When Will You Get Your Refund?

The IRS aims to have most EITC-related refunds in your bank accounts by March 1, provided there are no issues with your tax return. You can track your refund status using the Where’s My Refund? tool or the IRS2Go mobile app.

7. Other Credits You May Qualify For

If you meet the requirements for EITC, you might also qualify for other tax credits:

- Child Tax Credit and the Credit for Other Dependents

- Child and Dependent Care Credit

- Education Credits

Need more info? You can always check out additional details through the IRS website.

There you have it—everything you need to know about the Earned Income Credit in a nutshell. Happy filing!