Unlocking the Secrets of IRS Form 2553: How to Become an S Corporation!

Hey there, business enthusiasts! 🌟 Have you ever wondered how some small businesses save big on taxes? The answer might just be in a little form called IRS Form 2553. Let’s dive into the details and discover how this form could benefit you and your business!

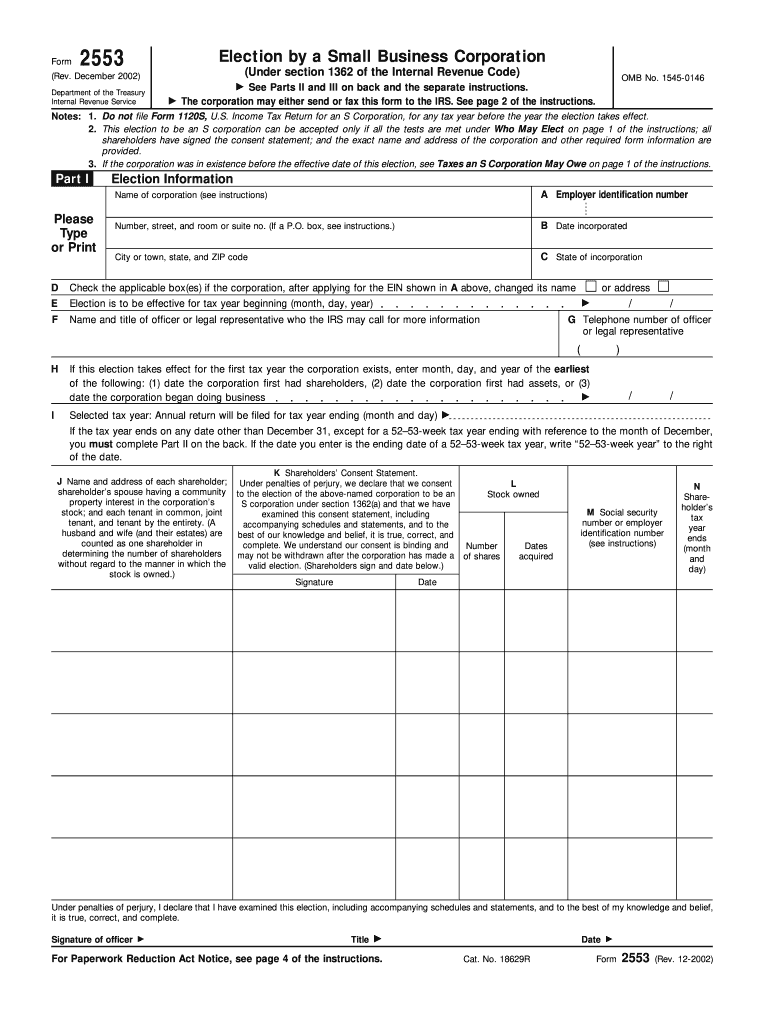

What is IRS Form 2553?

IRS Form 2553, officially known as “Election by a Small Business Corporation,” is the key to electing S Corporation status. What’s an S Corporation, you ask? It’s a type of corporation that meets specific Internal Revenue Code requirements, allowing its owners to enjoy some sweet tax benefits. 🌈

Why Should You Consider Filing Form 2553?

Great question! Here are a few perks of electing S Corp status:

Who Can File Form 2553?

Not every business can elect S Corp status. To be eligible, your business must:

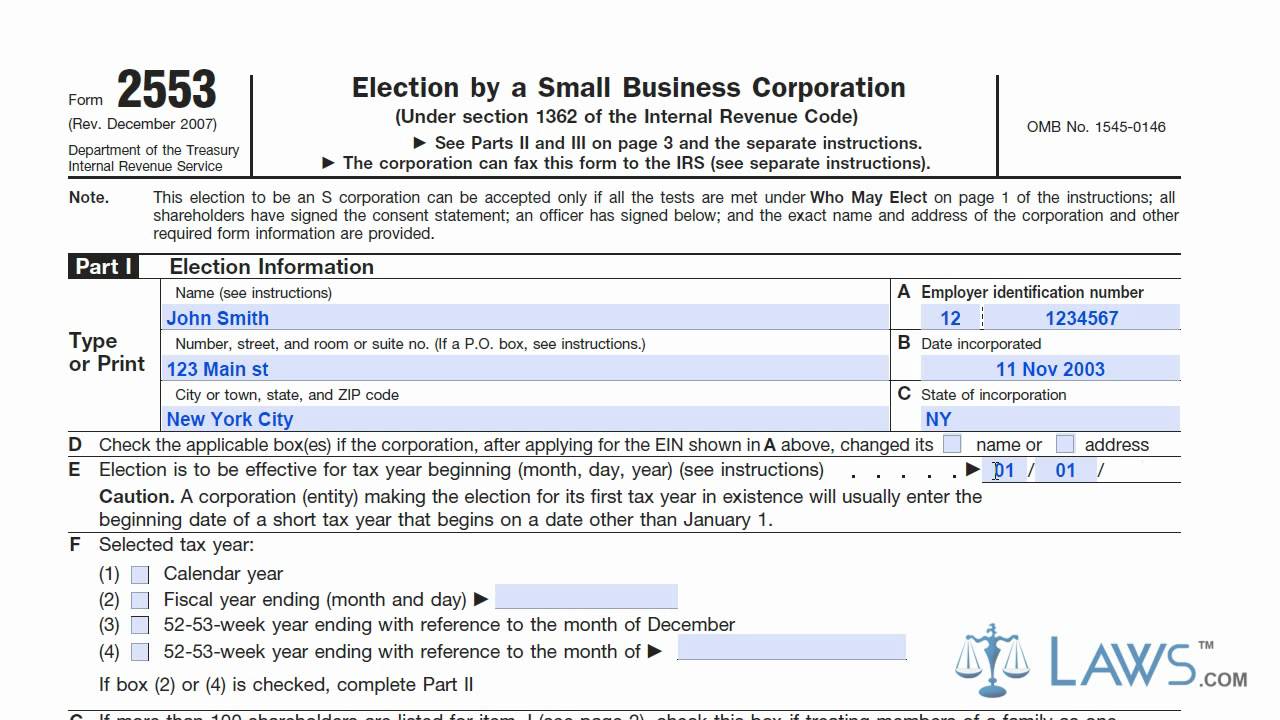

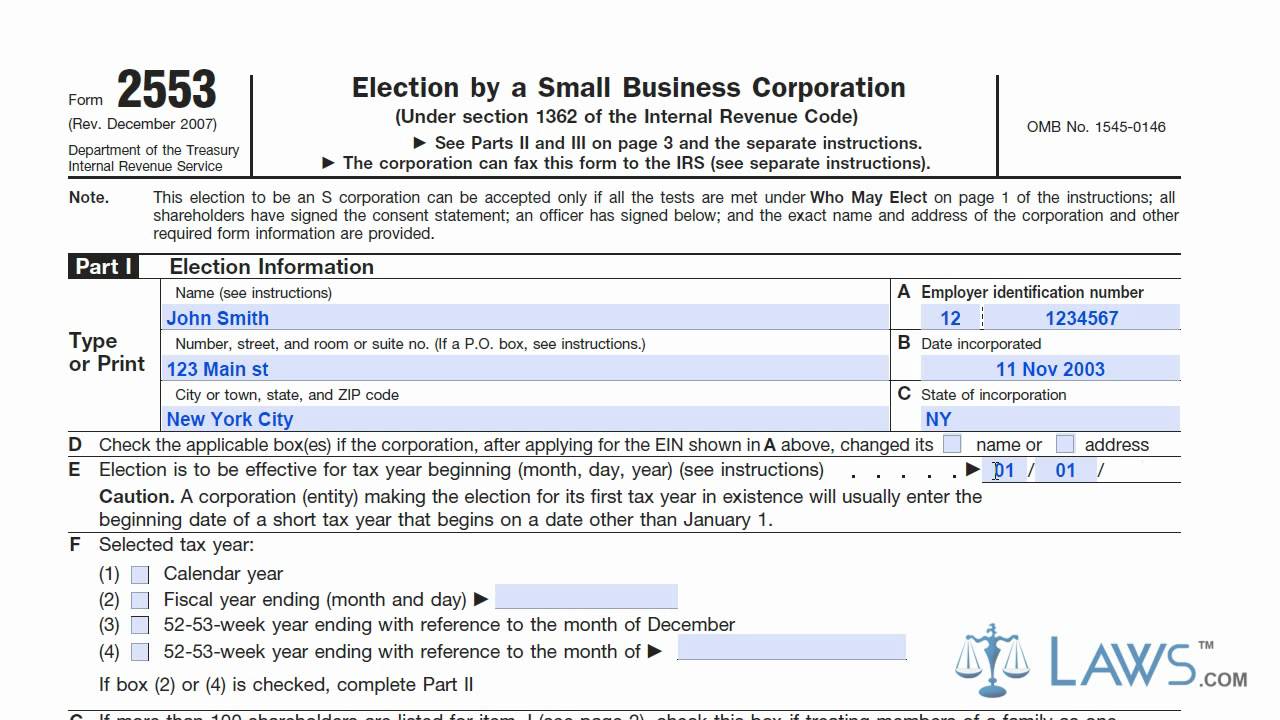

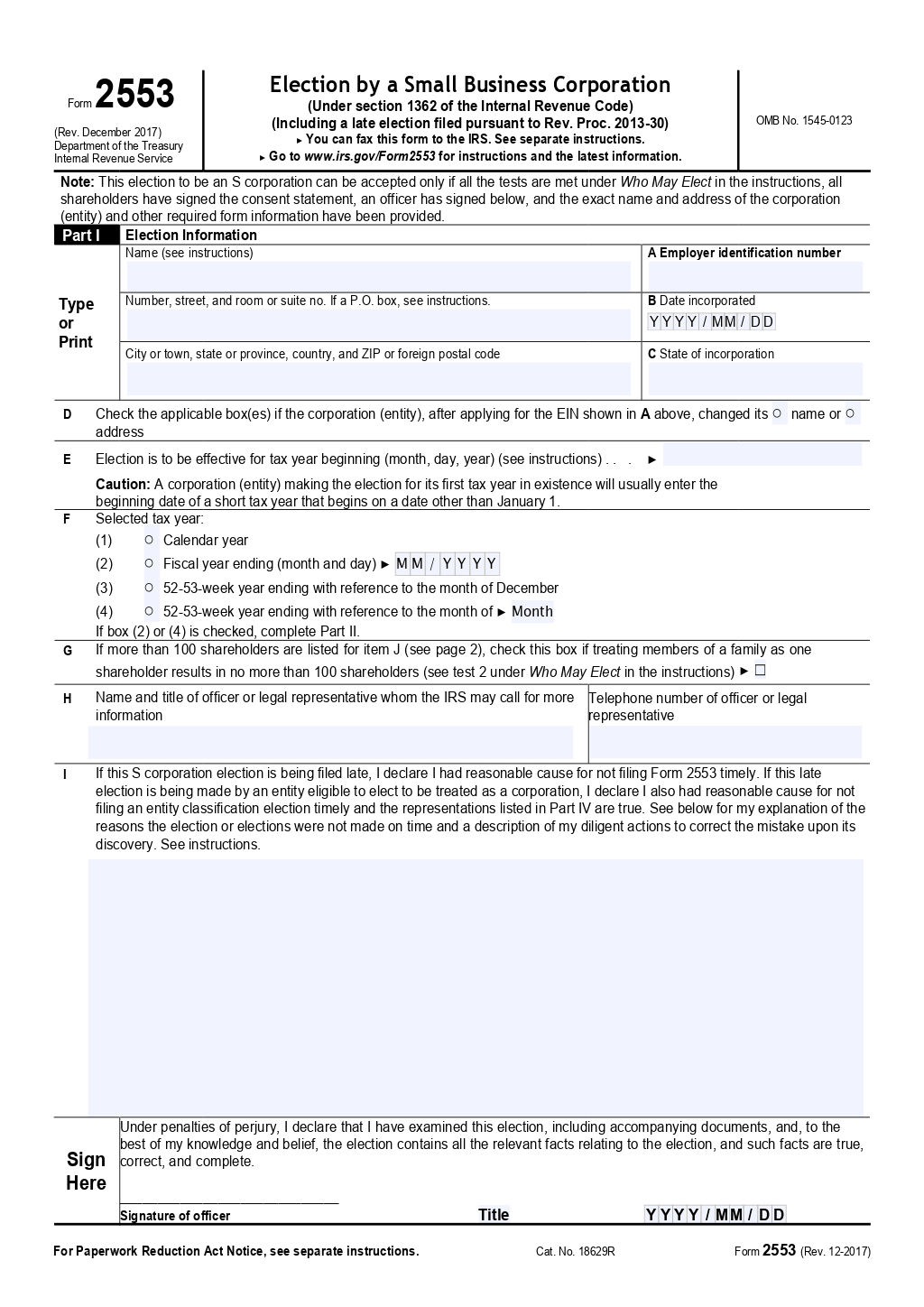

Step-by-Step Guide to Completing Form 2553

Ready to get started? Follow these steps:

1. Fill Out Basic Information

2. Indicate the Effective Date

Choose the effective date of the S Corp election, usually the start of the tax year. 📅

3. Get Consent from Shareholders

All shareholders must consent to the election by signing column K of Form 2553. 🤝

4. Submit the Form

File Form 2553 with the IRS within 75 days of the beginning of the tax year or incorporation. 📨

Common Pitfalls to Avoid

Here are some tips to ensure a smooth process:

Maintaining Your S Corp Status

Once you’re an S Corp, keep up with these tasks to maintain compliance:

Is Form 2553 Right for Your Business?

Deciding whether to elect S Corp status can be a game-changer. Consult with a tax advisor to weigh the benefits (and potential drawbacks) for your unique situation. For more detailed information, check out the IRS Form 2553 or head over to the IRS page about Form 2553.

That’s a wrap, folks! Whether you’re a budding entrepreneur or an established business owner, understanding Form 2553 can open the door to significant tax savings and financial growth. Happy filing! 🎉