FBAR: Everything You Need to Know in a Fun and Friendly Way!

Hey there, financial adventurers! 🌟 Have you ever wondered what FBAR is and why everyone keeps talking about it? Well, you’re in the right place! Buckle up, because we’re about to dive into the world of FBAR in the most engaging and informative way possible.

What is FBAR Anyway? 🤔

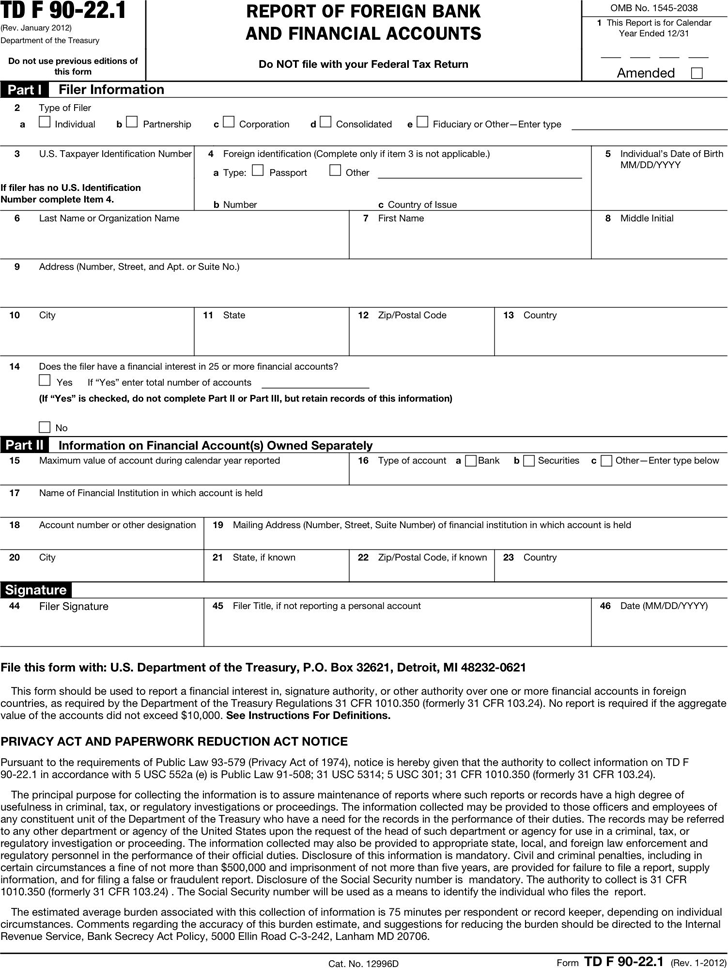

FBAR stands for Foreign Bank and Financial Accounts Report. It’s a special report that certain U.S. persons need to file annually if they have financial interests in or authority over foreign accounts that exceed $10,000 at any time during the calendar year. Sounds tricky? Don’t worry, we’ll break it down!

Who Needs to File an FBAR? 📝

If you’re a U.S. person—this includes citizens, residents, corporations, partnerships, LLCs, trusts, and estates—you must file an FBAR if:

- You have a financial interest in or signature authority over at least one financial account located outside the United States.

- The aggregate value of those foreign financial accounts exceeded $10,000 at any time during the calendar year.

Examples of Foreign Financial Accounts 📊

Generally, a foreign financial account is any account at a financial institution located outside the U.S. This includes:

- Bank accounts

- Brokerage accounts

- Mutual funds

But wait, there’s more! Even if your account didn’t produce taxable income, it still needs to be reported if it fits the criteria mentioned above. Crazy, right?

Exceptions to the Rule 🚫

Not all foreign accounts need to be reported. Here are a few exceptions:

- Correspondent/Nostro accounts

- Accounts owned by governmental entities or international financial institutions

- Accounts maintained on a U.S. military banking facility

For a detailed list of exceptions, check out this helpful guide on FBAR Exceptions.

When and How to File Your FBAR ⏱️

The FBAR is an annual report due April 15 following the calendar year being reported. Thankfully, you automatically get an extension to October 15 if you miss the April deadline. No need to file an extension request—cool, right?

The form must be filed electronically through FinCEN’s BSA E-Filing System. If you prefer to paper-file your FBAR, special permission is needed. For more details, check out the FBAR Filing Instructions.

Penalties for Non-Compliance 🚨

We get it—sometimes life gets busy, and you might miss a filing. But beware! Penalties for not filing an FBAR can be severe—both civil and criminal. Penalties depend on your situation, but better safe than sorry!

Forgot to File? There’s Hope! 🌈

If you missed filing and the IRS hasn’t contacted you about it, file those delinquent FBARs ASAP to minimize potential penalties. If you’re unsure or worried, it’s always a good idea to consult a tax professional.

Need Help? You’re Not Alone! 🤝

Understanding FBAR can be tricky, but don’t worry! There are experts like Golding & Golding who specialize in international tax and offshore disclosure. They can provide the assistance you need to navigate these waters smoothly.

So there you have it—your ultimate guide to understanding FBAR in a fun and friendly way! Got more questions? Feel free to drop them in the comments below, and let’s keep the conversation going! 🚀