Child Tax Credit July 2024 Payment Dates: Everything You Need to Know!

Hey there, parents! If you’re searching for the latest scoop on the Child Tax Credit July 2024 payment dates, you’ve come to the right place. We’ve gathered all the info you need to stay updated and stress-free. Let’s dive into the details!

When Will the Child Tax Credit Payments Start in July 2024?

The U.S. government typically disburses Child Tax Credit payments on a monthly basis. For July 2024, expect the payments to roll out around mid-month. While specific dates haven’t been confirmed yet, the pattern from previous years suggests that payments usually begin in the second or third week of each month.

How Much Will You Receive?

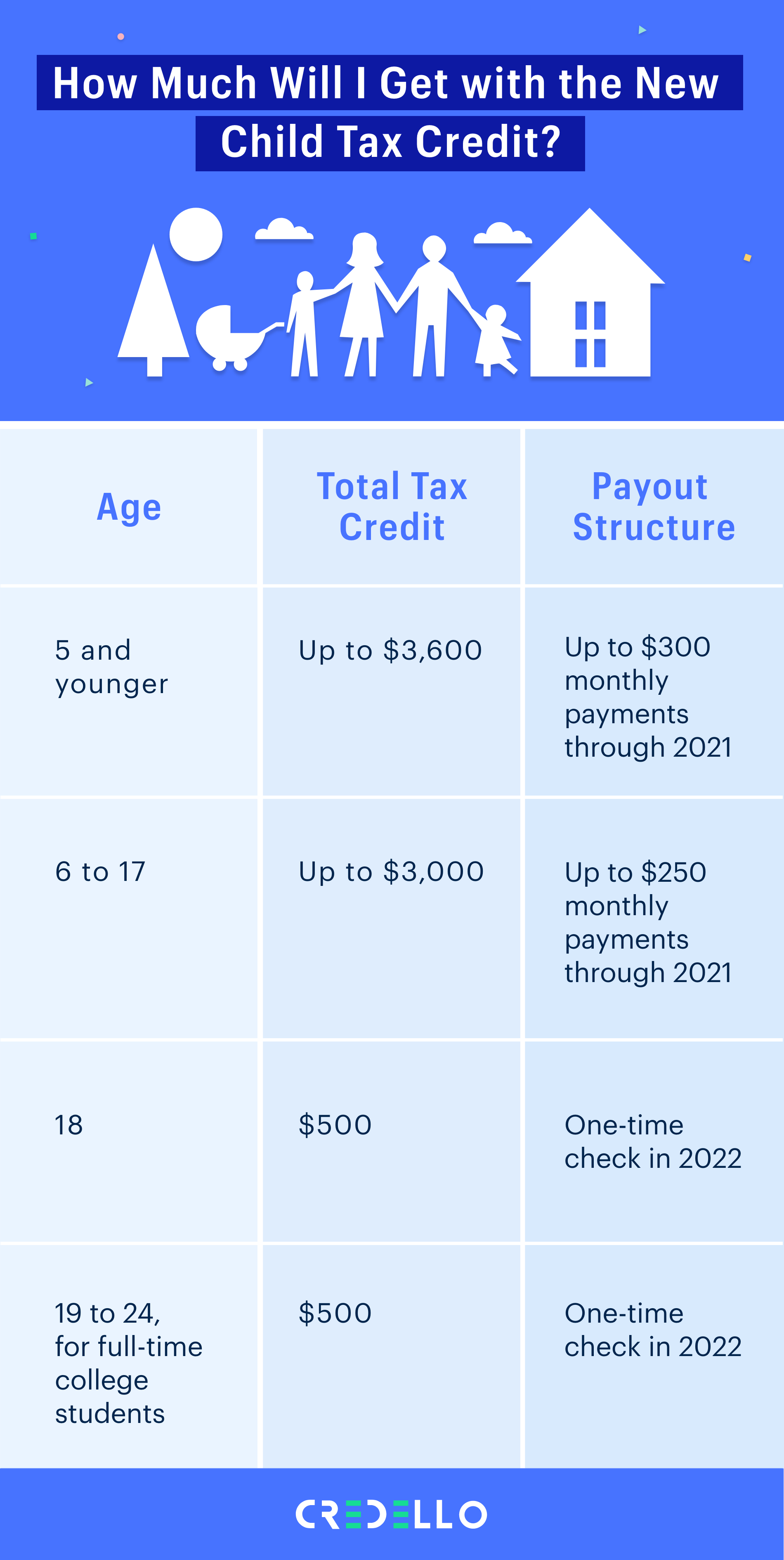

The Child Tax Credit aims to provide financial relief to families with children under 17 years old. Here’s a quick breakdown of what you can expect:

- Families with children under six can receive up to $300 per month.

- Families with children aged six to seventeen can receive up to $250 per month.

These amounts may vary based on your income and the latest IRS guidelines. To stay updated, you can visit the official IRS website for real-time information.

Am I Eligible for the July 2024 Payment?

Wondering if you qualify? Here are the key eligibility criteria you need to meet:

- Your dependent child must be under 17 years old by the end of the tax year.

- Both you and your child must be residents of the United States.

- The child must be your direct relative (son, daughter, grandchild, sibling, etc.).

- You must have contributed at least 50% of the child’s support in the previous year.

How to Check Your Payment Status

If you’re eager to know the status of your Child Tax Credit payment, you can use the IRS Child Tax Credit Update Portal for real-time updates.

Final Thoughts

The Child Tax Credit is a lifeline for many families, especially during challenging times. Staying updated on payment dates and eligibility is crucial. Make sure to check the IRS website for the latest info.

If you found this blog post helpful, don’t forget to share it with other parents who might benefit from this information. Got questions or comments? Drop them below and let’s chat!

Until next time, stay informed and stress-free!