Understanding Per Diem Rates: Your Complete Guide!

Hey there! If you’ve ever traveled for work, you’ve probably come across the term “per diem rates.” But what are they exactly? How are they set? And what do they cover? Don’t worry; we’ve got you covered with all the answers in this fun and informative post. Let’s dive into the world of per diem rates!

What is “Per Diem” Anyway?

“Per diem” is a fancy Latin term that translates to “per day.” In the context of business travel, it’s an allowance given to employees to cover lodging, meals, and incidental expenses while they’re traveling for work. Simple, right?

How Are Per Diem Rates Determined?

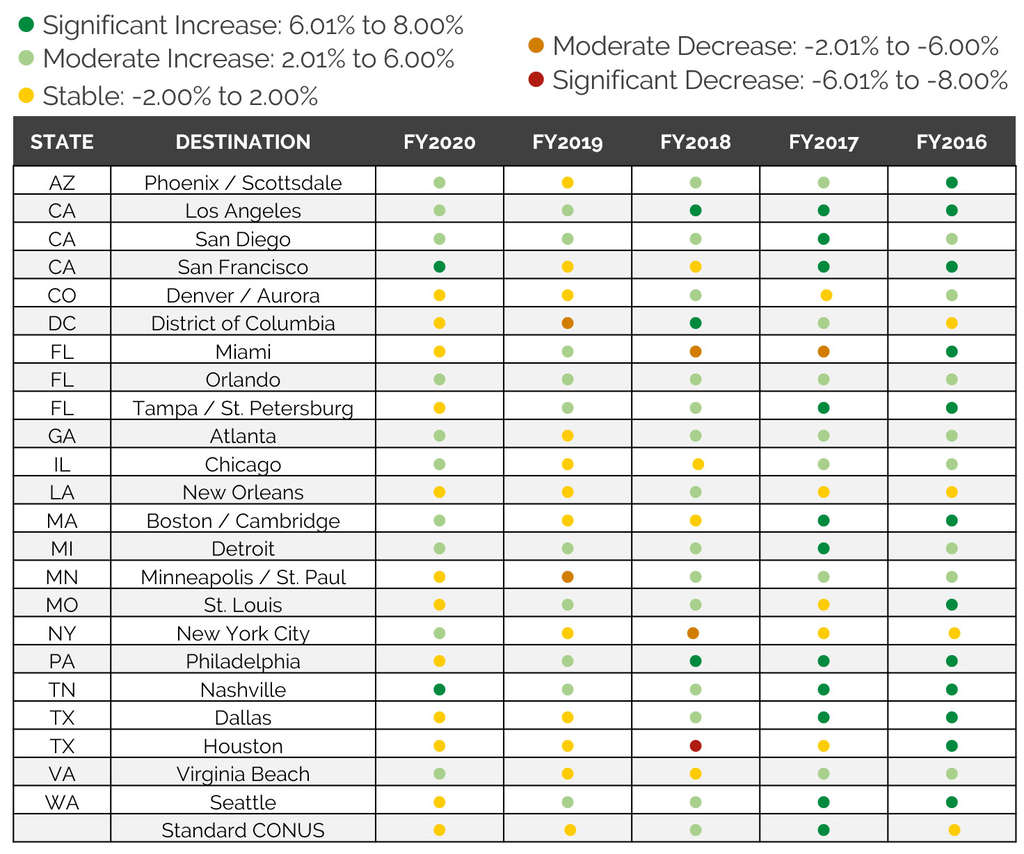

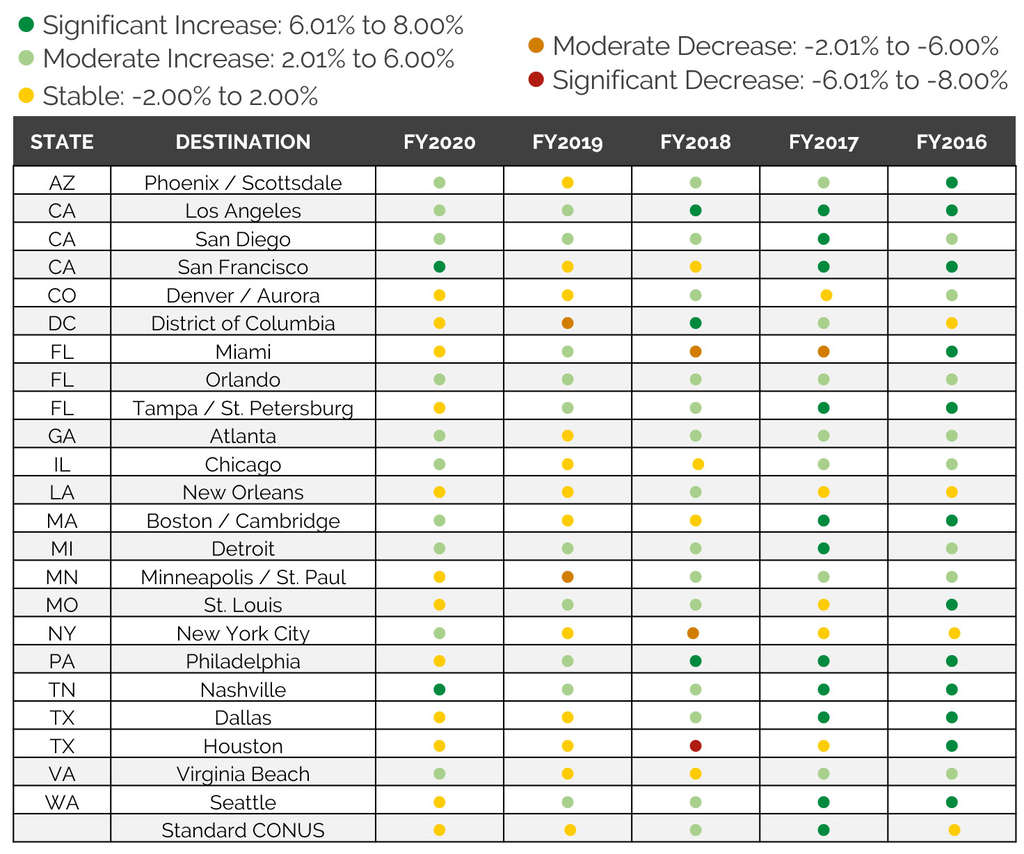

The U.S. General Services Administration (GSA) sets the per diem rates for federal employees traveling within the continental United States (CONUS). For travel in places like Alaska, Hawaii, and U.S. territories, the Department of Defense (DOD) sets the rates. For foreign travel, the State Department is in charge.

For a detailed look at the rates, you can visit the official GSA page here.

Things to Note About Per Diem Rates:

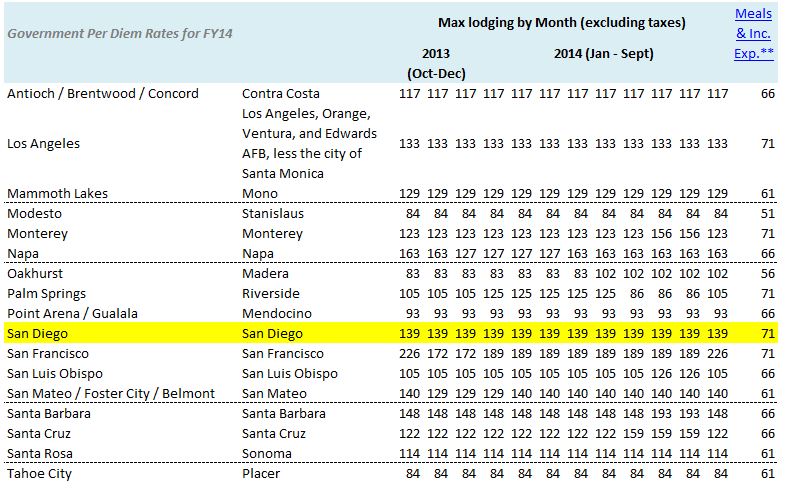

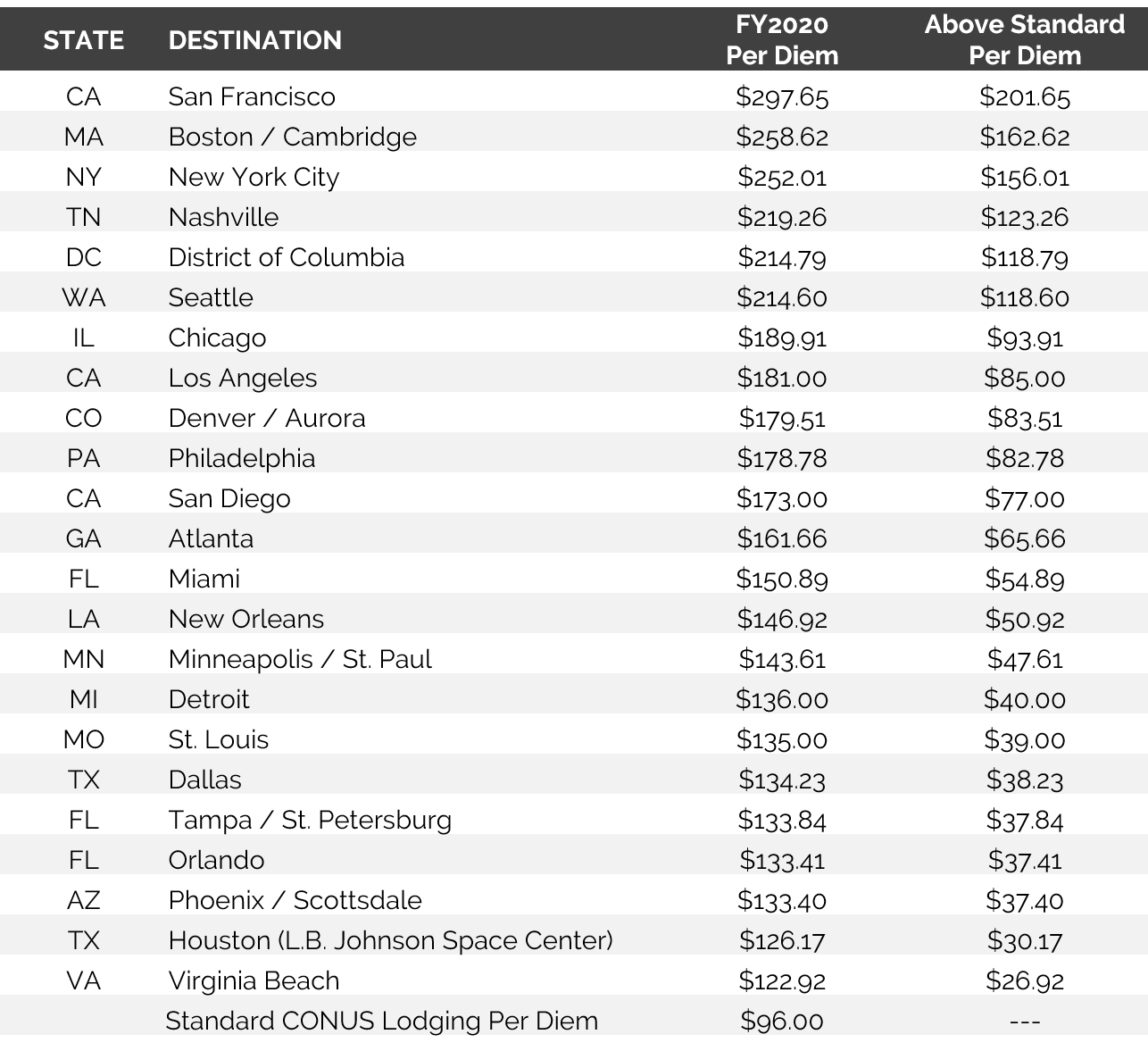

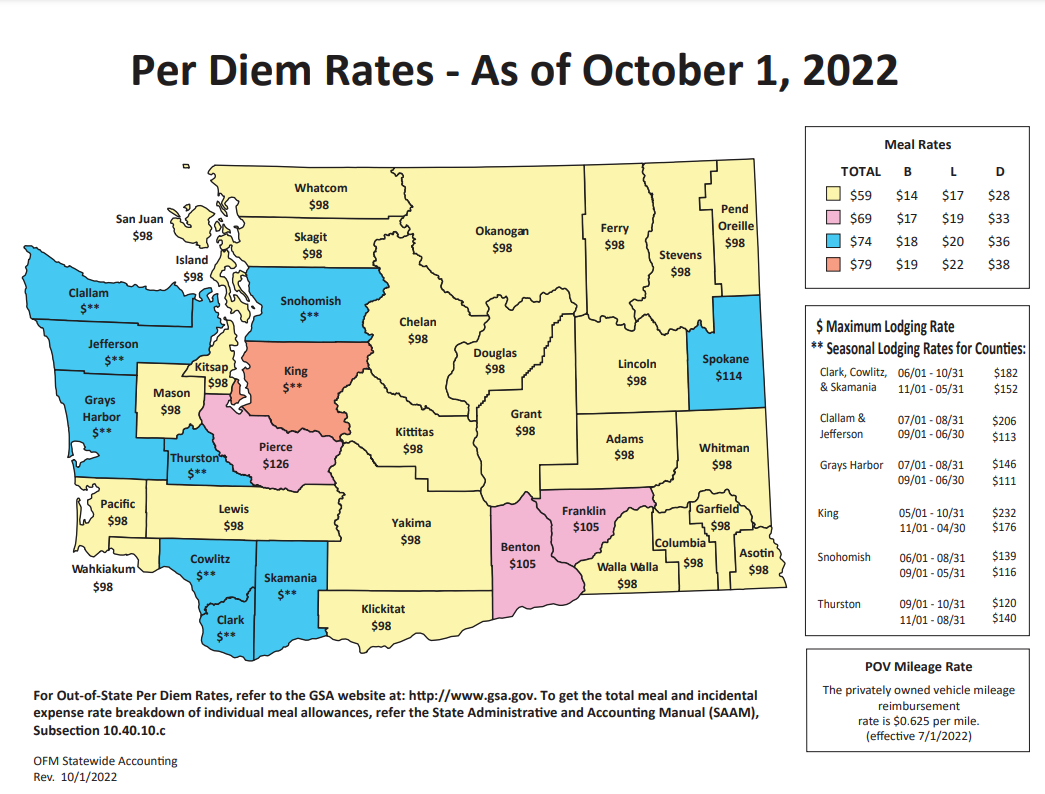

- Rates vary based on location, and some areas have different rates called Non-Standard Areas (NSAs).

- The rates are set using average daily rate (ADR) data from local lodging properties, with adjustments to ensure fairness.

- Per diem rates apply to the location of your work activities, not necessarily where you stay.

What’s Included in the Per Diem Allowance?

The per diem allowance generally covers three main categories:

- Lodging: This is a maximum rate; you’ll be reimbursed for the actual cost up to the set limit.

- Meals: Includes all meals during travel and covers taxes and tips.

- Incidental Expenses: This encompasses minor expenses like tips for porters, baggage carriers, and hotel staff.

FAQs about Per Diem Rates

- Are lodging taxes included in the per diem rate? No, lodging taxes are reimbursed separately as a miscellaneous travel expense.

- Can hotels refuse to honor the per diem rate? Yes, it’s up to each hotel whether they honor the rate or not.

- Do I need to provide receipts? Yes, you need to provide receipts for lodging and any expense over $75.

- What if there are no hotels available at the per diem rate? You can ask your agency to authorize actual expense reimbursement up to 300% of the per diem rate.

How to Find Per Diem Rates?

Finding the per diem rate for a specific location is easy! You can use the GSA’s Per Diem Rates tool. Simply enter the city, state, or ZIP code, or click on a state from the map. If the city or county isn’t listed, the standard CONUS rate applies.

For more detailed information, check out the full list of FAQs on the GSA website here.

Wrapping It Up

There you have it! A comprehensive guide to understanding per diem rates. Whether you’re a federal employee or just curious about how business travel works, we hope this guide has been helpful. Safe travels and happy per dieming!