Everything You Need to Know About the 2024 Standard Deduction

Hey there, tax-savvy folks! 🌟 If you’re here, it’s probably because you’ve heard whispers about the changes in the 2024 standard deduction and you’re eager to know more. Well, you’re in the right place! We’ve got all the juicy details right here. Let’s dive in! 🏊♀️

What’s the Buzz About the 2024 Standard Deduction?

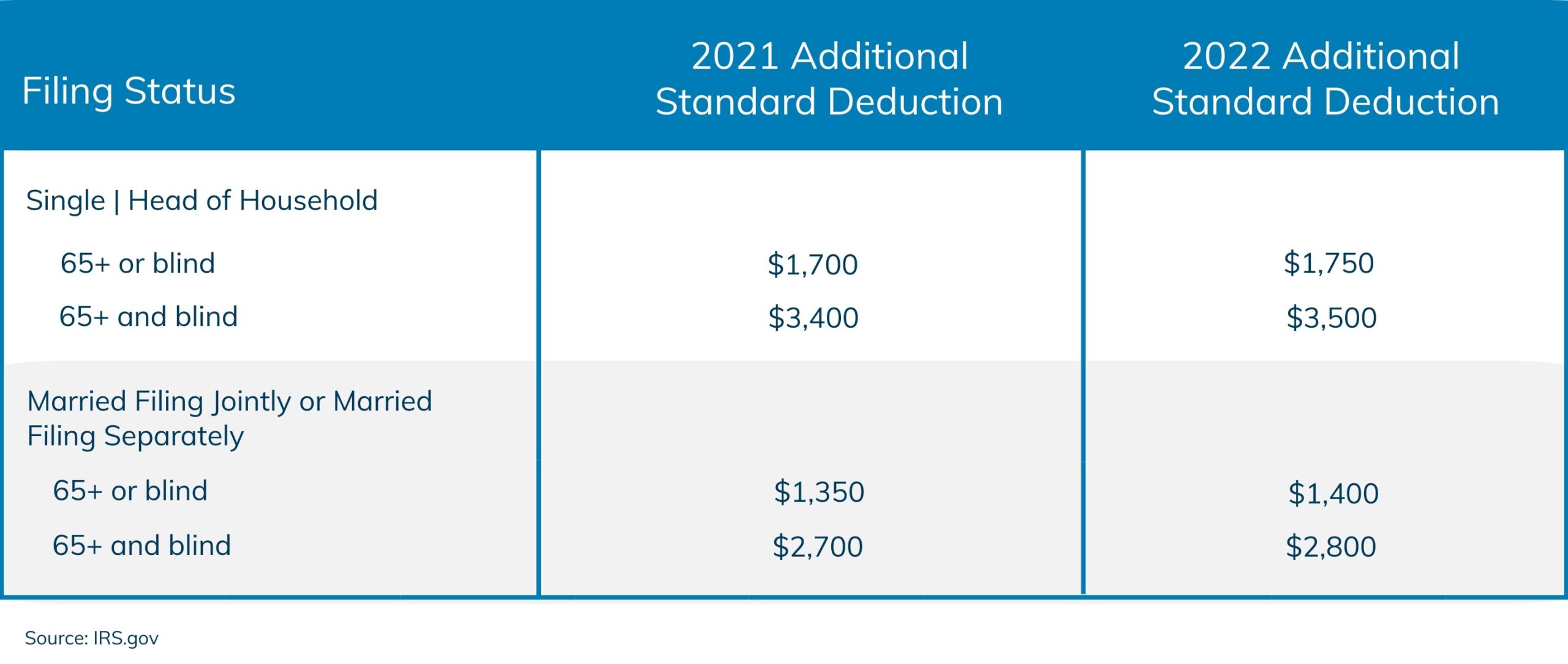

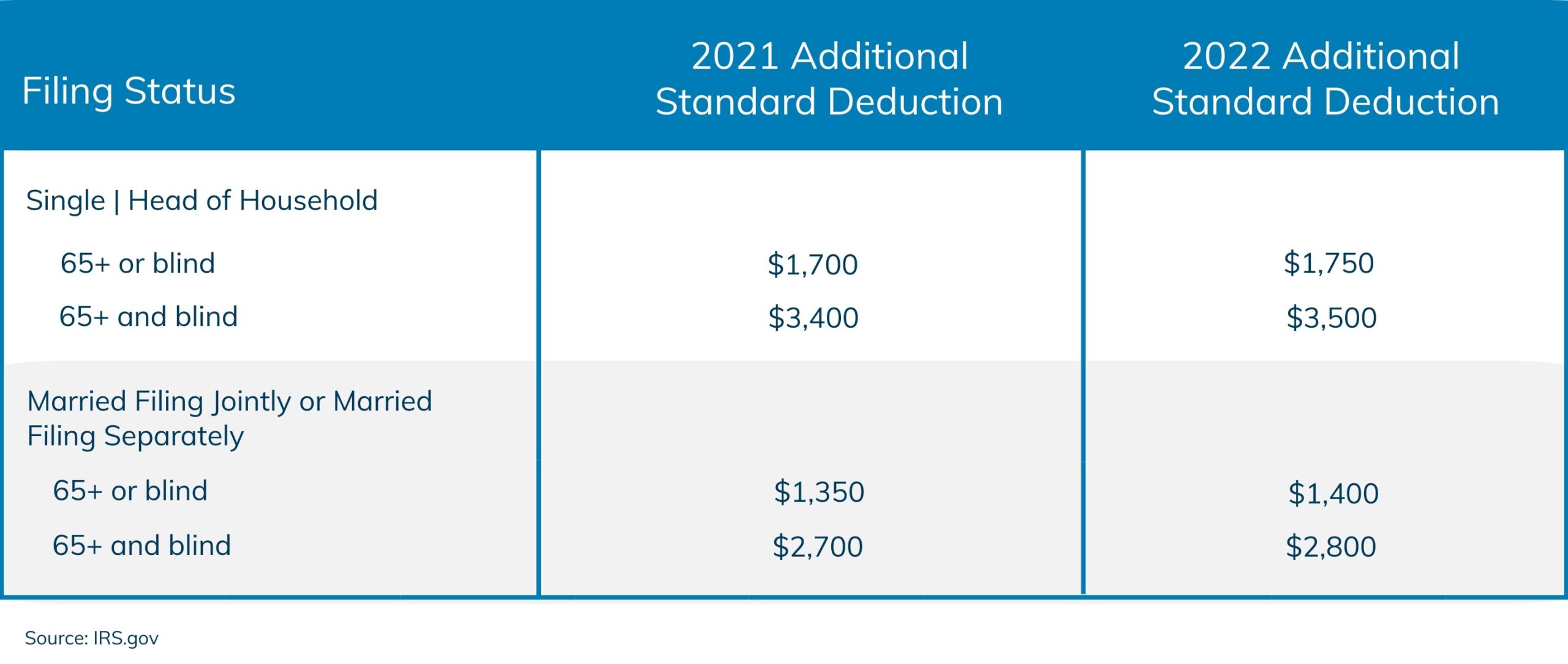

In response to inflation and the changing economic landscape, the IRS has made some adjustments to the standard deduction for 2024. This year, the changes are particularly significant, offering some potential tax breaks for many Americans. But what exactly are these changes? Let’s break it down.

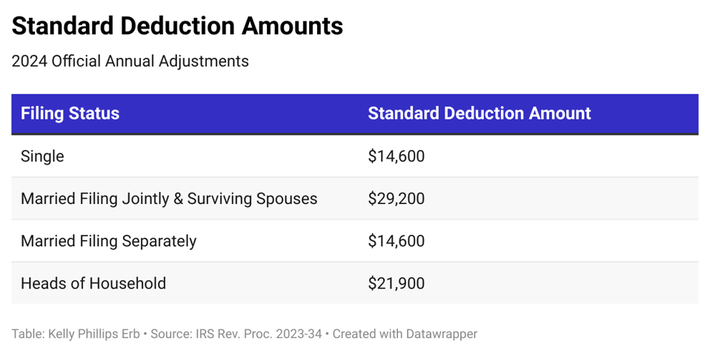

The New 2024 Standard Deduction Amounts

- Married Couples Filing Jointly: The standard deduction rises to $29,200, an increase of $1,500 from 2023.

- Single Taxpayers: The standard deduction increases to $14,600, up by $750 compared to the previous year.

- Heads of Household: Unmarried taxpayers with dependents can take a standard deduction of $21,900 in 2024, a $1,100 increase from 2023.

For example, in 2024, an individual taxpayer with an income of $50,000 can take the standard deduction and reduce their taxable income to $35,400. Not too shabby, right? 😎

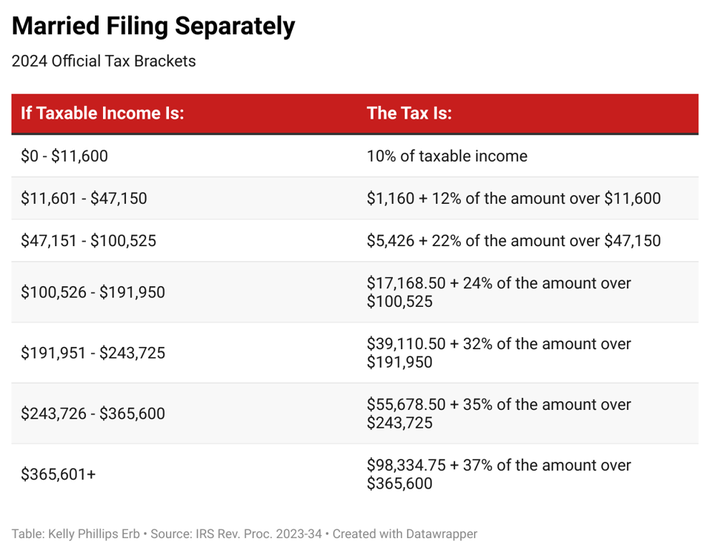

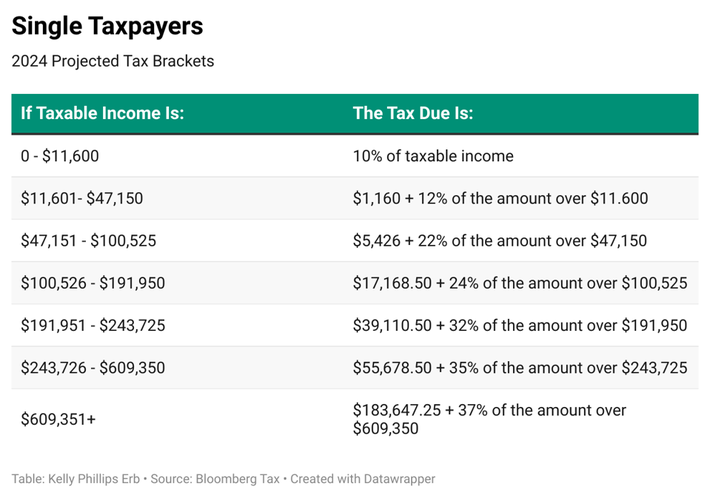

Changes in Tax Brackets for 2024

With the new tax brackets for 2024, some taxpayers may find their tax bill to be lower than expected. Here’s a quick breakdown:

- 10%

- 12%

- 22%

- 24%

- 32%

- 35%

- 37%

For instance, if you earned $46,000 in 2023, you were in the 22% federal income tax bracket. But with the same $46,000 income in 2024, you’d be in a 12% tax bracket. Noticing the savings? Yep, we thought so! 💸

Other Noteworthy Tax Changes Coming in 2024

Increased Contribution Limits for Retirement Plans

Taxpayers can boost their contributions to tax-advantaged retirement savings plans. The contribution limit for 401(k) and 403(b) plans increases to $23,000 annually. Employees aged 50 and over can contribute an additional $7,500, totaling $30,500.

IRA Contribution Limits

The IRA contribution limit for 2024 is $7,000 for workers below the age of 50 and $8,000 for those over 50. This is an increase from 2023.

Tax Credits and Deductions

If you’re someone who itemizes their deductions, this year may bring some good news for you too! For example, the maximum tax credit for adoption expenses increased to $16,810 from $15,950.

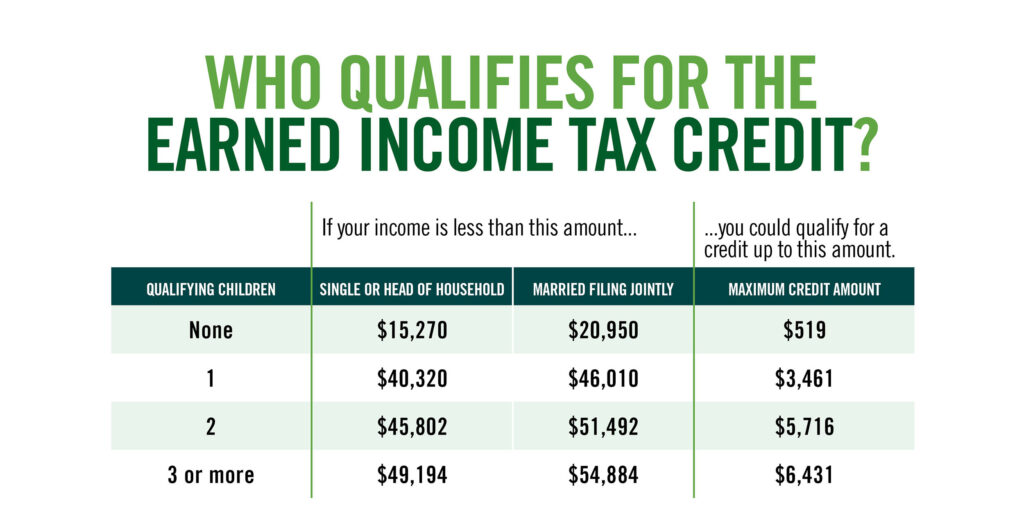

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit is a fabulous way to reduce your tax liability. Here are the EITC requirements for 2024:

- No tax credit if claimed on foreign earned income tax form (2555 or 2555-EZ).

- Investments in 2024 totaling $11,600 or less.

- Filers must be at least age 25 and no older than 65 if filing for the credit without children or dependents.

Clean Vehicle Tax Credit

Planning to go green in 2024 by purchasing an electric vehicle (EV)? You might qualify for a tax credit up to $7,500. Rather than waiting until tax season, you can actually take the credit as a rebate when you buy the vehicle.

Additional 2024 Tax Changes to Keep in Mind

- Capital Gains Tax: Individual tax filers with total taxable income of $47,025 or less will not pay any capital gains tax.

- Kiddie Tax: For child wage earners under age 19, the first $1,300 of unearned income is tax-free.

- Flexible Spending Accounts: The dollar limit increases to $3,200 in 2024.

- Health Savings Accounts: Contribution limits have been increased to $4,150 for individuals and $8,300 for families.

- Foreign Earned Income Exclusion: The exclusion amount increases to $126,500.

- Estate and Gift Tax: The estate tax exclusion amount is $13.6 million. The gift tax exclusion increases to $18,000.

If you’re looking for more detailed information, check out the IRS Publication 505.

Final Thoughts

So there you have it! A comprehensive guide to the 2024 standard deduction and other significant tax changes. It’s time to get ahead of the game and plan your finances smartly for the upcoming year. Consulting with a tax professional is always a good idea to maximize your benefits and minimize your liabilities. Here’s to a smooth tax season! 🎉