Everything You Need to Know About Self Employment Tax!

Hey there, fellow freelancers and small business warriors! 🌟 Navigating the maze of taxes can be tricky, especially when you’re self-employed. But don’t worry, we’re here to break it down for you in simple, Onedio style! Ready? Let’s dive in!

What is Self Employment Tax?

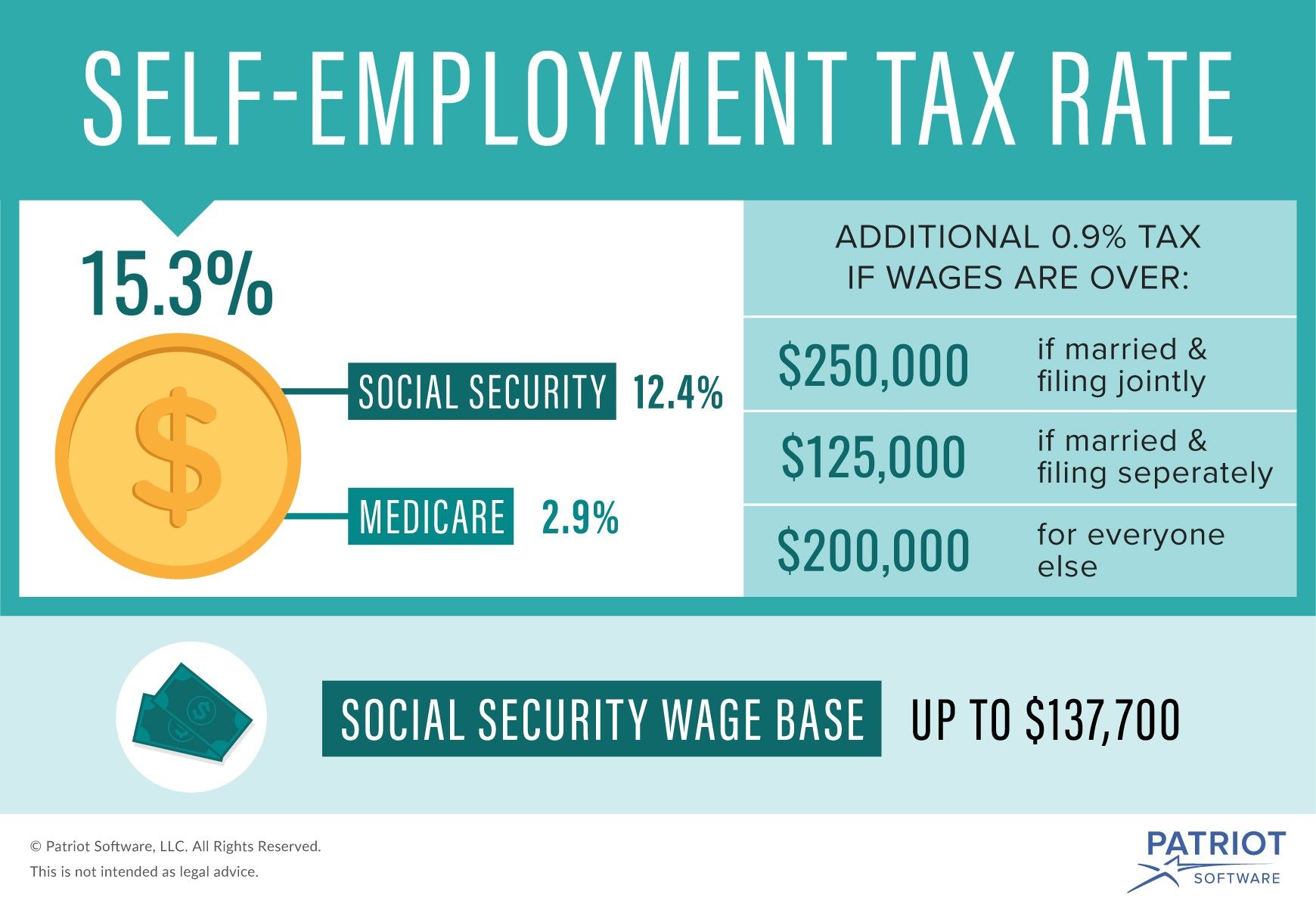

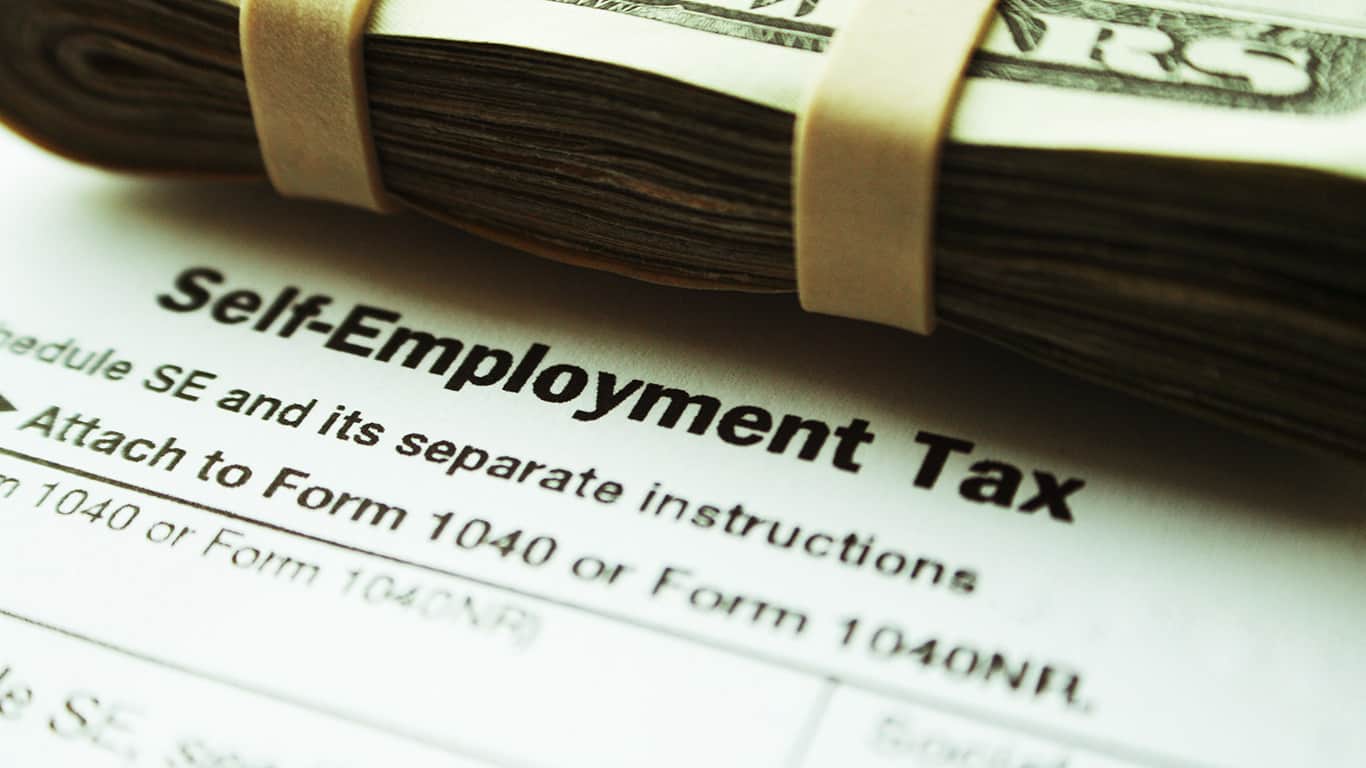

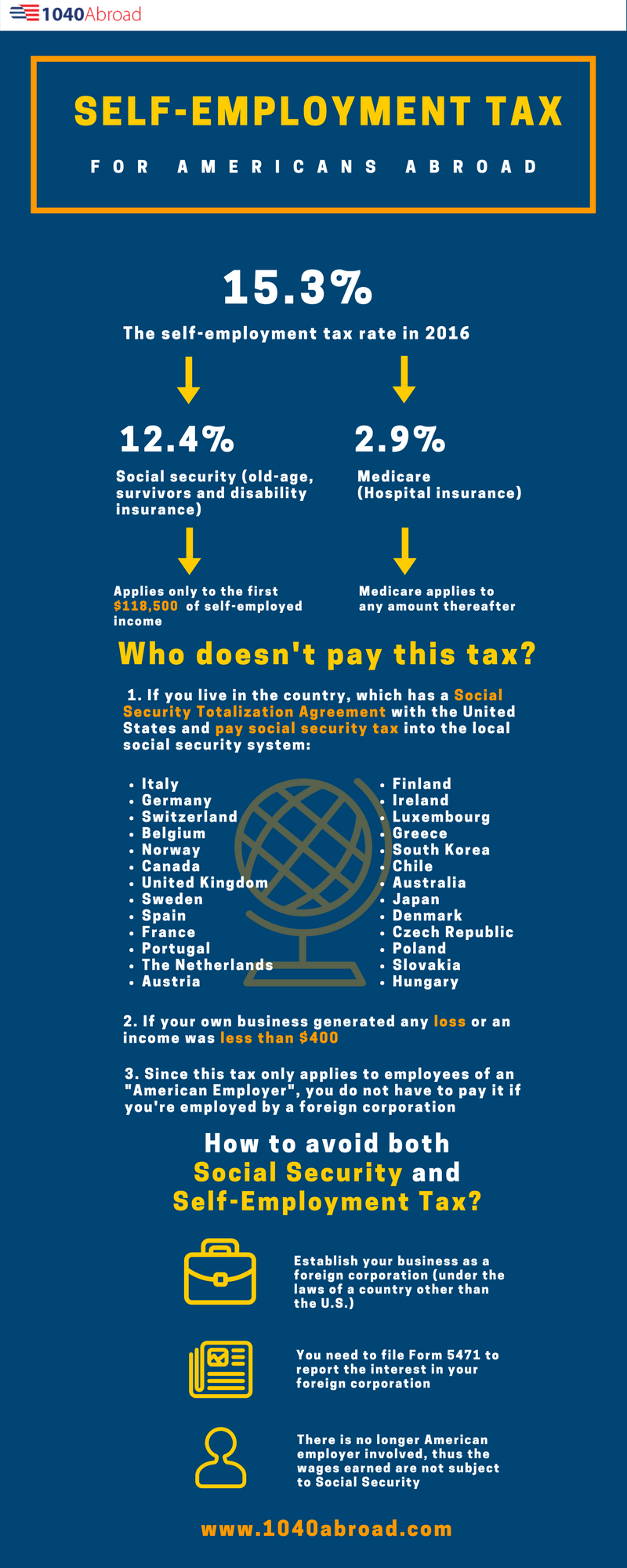

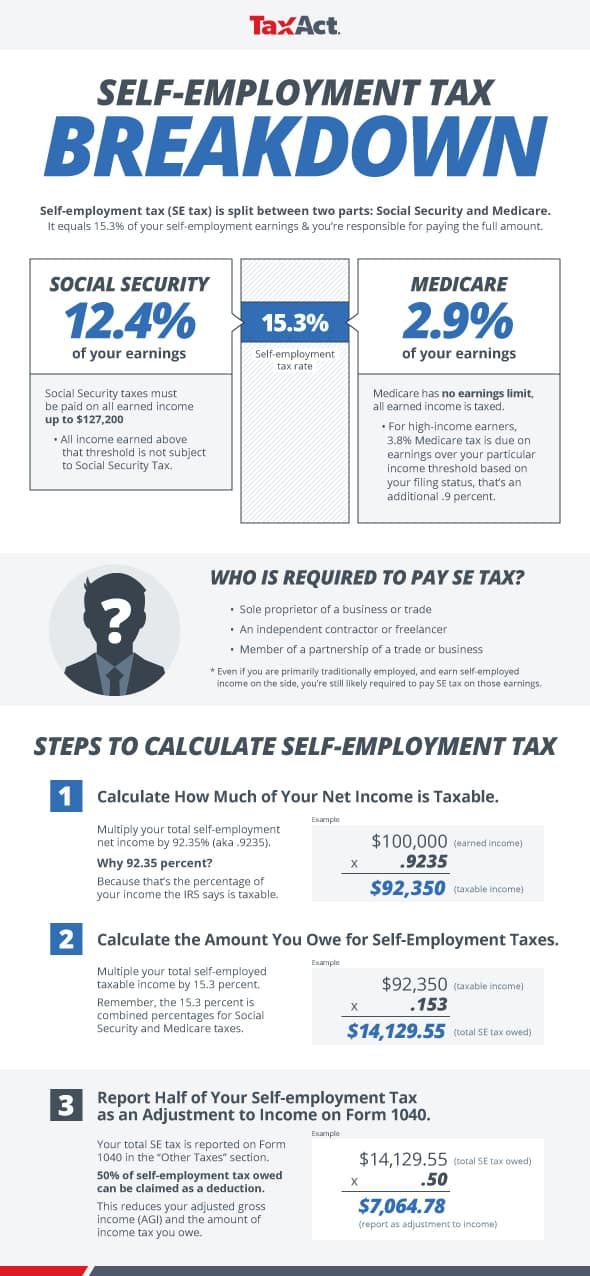

In simple terms, self employment tax is a tax consisting of Social Security and Medicare taxes. When you’re self-employed, you’re both the employer and the employee, so you pay the full 15.3% rate, unlike W-2 employees who split this rate with their employers.

Do You Need to Pay It?

If you earned more than $400 in net earnings from self-employment during the year (or $108.28 from church employment), you need to pay self-employment tax. Yes, it’s that straightforward! 😊

How to Calculate It?

- Grab your IRS Schedule C to calculate your net earnings (gross income minus expenses).

- 92.35% of your net earnings are subject to self-employment tax.

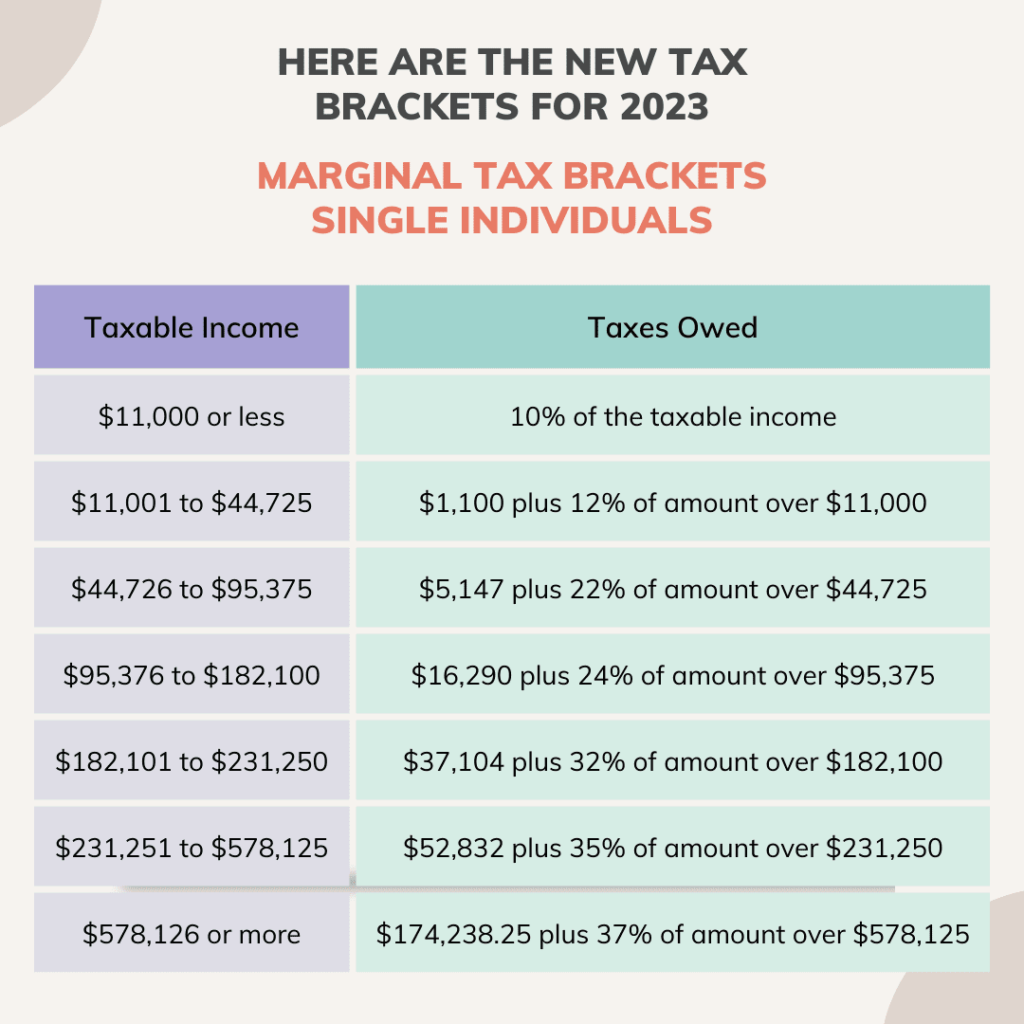

- Apply the 15.3% tax rate to this amount. Reminder: For 2024, only the first $168,600 is subject to the Social Security portion, but all amounts are subject to Medicare tax.

Easy peasy, right?

Boost Your Tax Knowledge with These Tips!

Form an S Corporation

Dividends (unearned income) aren’t subject to self-employment tax, only your salary is. By forming an S Corporation, you can split your income between salary and dividends to save on taxes!

Deduct Half of Your Self Employment Tax

Good news! You can deduct half of your self-employment tax when calculating your federal taxable income. For instance, if you owe $7,650 in self-employment tax, you can deduct $3,825 from your federal taxable income. Every bit helps, right?

Claim Business Expenses

From office supplies to travel costs, deduct those ordinary and necessary business expenses to lower your taxable income. Remember, you can only deduct what’s truly business-related. That trip to Hawaii better be for a business conference! 🌴

Health Insurance Deduction

You can deduct 100% of your health insurance premiums for yourself and your dependents as long as you have a net profit for the year. This reduces your overall taxable income significantly.

Defer Income

Consider deferring some income to the next tax year to avoid higher tax brackets. This strategy can help manage your tax obligations more effectively.

Get More Resources!

If you’re itching for more detailed information straight from the horse’s mouth, check out the official IRS page on self employment tax!

Feeling more confident about tackling those self-employment taxes? Let’s keep the conversation going! Share your thoughts and questions in the comments below. And remember, we’re in this together!