Child Tax Credit Update 2024: What You Need to Know

The Child Tax Credit (CTC) is back with some significant updates for 2024! Whether you’re familiar with the term or this is your first time hearing about it, we’re here to break down everything you need to know in the simplest way possible. Ready? Let’s dive in!

What is the Child Tax Credit (CTC)?

The Child Tax Credit is a tax benefit designed to provide financial relief for families with children under the age of 17. This credit helps reduce your federal income tax, putting more money back in your pocket for those endless child-related expenses like groceries, school supplies, and healthcare.

How Much is the CTC Worth in 2024?

For the 2024 tax year, the CTC is worth up to $2,000 per child. One of the exciting updates is that the refundable portion of the credit, known as the Additional Child Tax Credit (ACTC), has increased to $1,700. This means if your CTC is more than your tax bill, you could get up to $1,700 back as a refund!

Who Qualifies for the Child Tax Credit?

To qualify for the CTC, your child must:

- Be under 17 years old at the end of the tax year.

- Live with you for more than half of the tax year.

- Be your dependent and meet citizenship requirements (U.S. citizen, U.S. national, or U.S. resident alien).

Your income also plays a crucial role:

- For single filers: The credit starts phasing out at a Modified Adjusted Gross Income (MAGI) of $200,000.

- For married couples filing jointly: The phase-out begins at a MAGI of $400,000.

- Above these income limits, the credit reduces by $50 for every $1,000 over the threshold.

How to Claim the Child Tax Credit

Claiming the CTC is straightforward but requires some paperwork. Here’s what you need to do:

Gather Necessary Documentation

- Social Security numbers for each qualifying child.

- Your tax documents (W-2s, income statements, etc.).

Fill Out Required Forms

- Form 1040 for your tax return.

- Form 8812 to calculate the CTC and other qualifying credits.

For more detailed info, check out the IRS’s official page on the Child Tax Credit.

Updates and Payments

No Monthly Payments in 2024

Unlike in some previous years, the CTC for 2024 will not be distributed as monthly payments. You will need to claim the full amount when you file your tax return, making accurate record-keeping more important than ever.

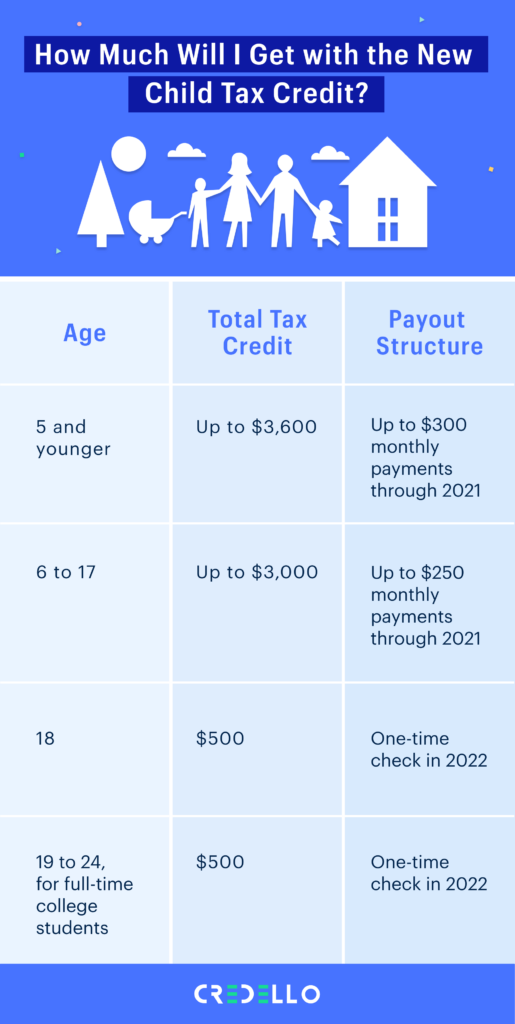

Sadly, the House of Representatives bill proposing advanced monthly payments for children under 6 at $300 and children ages 6 to 17 at $250 failed to pass. So, for now, we’re back to the traditional system.

Additional Tips for Maximizing Your CTC

If you’re worried about missing out on any part of the CTC, consider working with a tax professional who can guide you through the forms and ensure you’re getting the most benefit possible.

And remember, you can always find the latest updates and more tips on tax credits by visiting reputable sources like Jackson Hewitt and NerdWallet.

Wrap-Up

The Child Tax Credit for 2024 brings valuable financial relief for families and understanding these updates is key to maximizing your benefits. Keep an eye on your income thresholds, gather the right documents, and claim your credit properly to make the most of this opportunity!

Got more questions? Drop them in the comments, and let’s chat!