2024 Standard Deduction: What You Need to Know!

Attention all taxpayers! The standard deduction for 2024 has been officially announced, and it’s time to get the scoop on all the details. Whether you’re filing as a single, married, or head of household, there’s something here for everyone. In this blog post, we’ll break down everything you need to know about the 2024 standard deduction in a fun and easy-to-read format. Let’s dive in!

What is the Standard Deduction?

The standard deduction is a specific dollar amount that reduces the amount of income on which you are taxed. It’s a no-questions-asked deduction that anyone can claim, which can be particularly beneficial if you don’t have enough itemized deductions to surpass the standard deduction amount.

New 2024 Standard Deduction Amounts

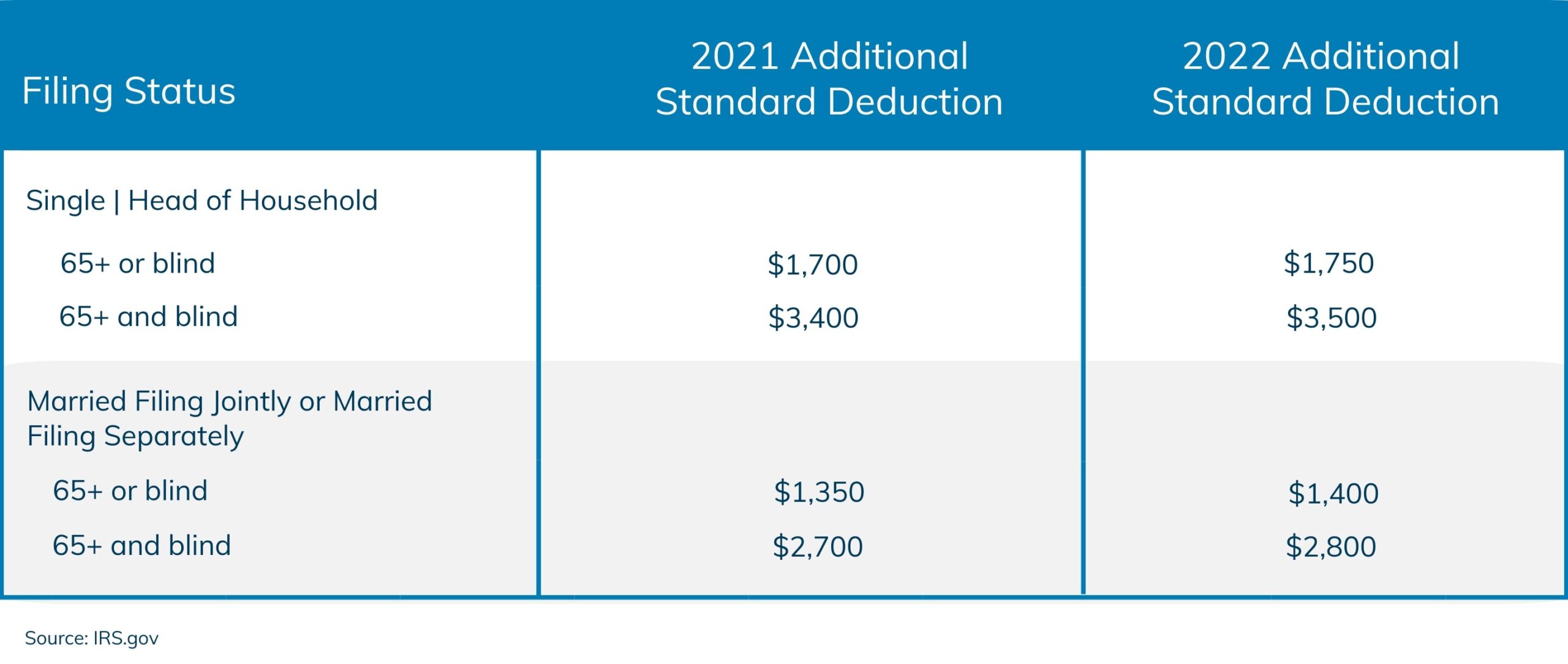

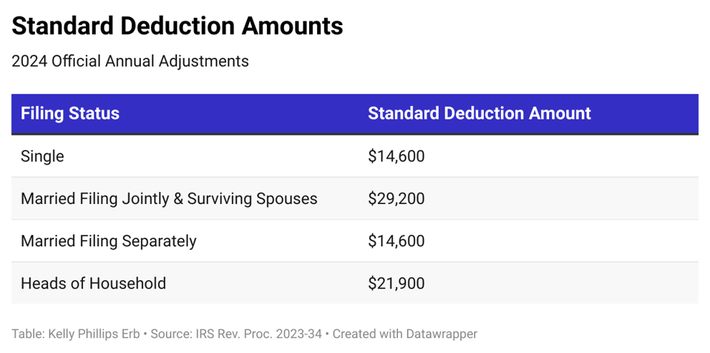

For 2024, the IRS has increased the standard deduction amounts for all filing statuses, reflecting inflation adjustments. Here are the new amounts:

- Single or Married Filing Separately: $14,600

- Married Filing Jointly or Qualifying Surviving Spouse: $29,200

- Head of Household: $21,900

These increases mean that more of your income is protected from taxation, which is always a good thing!

Why the Increase?

The IRS adjusts the standard deduction amounts each year to account for inflation. This is to ensure that the deduction retains its real value over time despite the rising cost of living. It’s all part of the effort to keep the tax system fair and equitable.

How Does This Affect You?

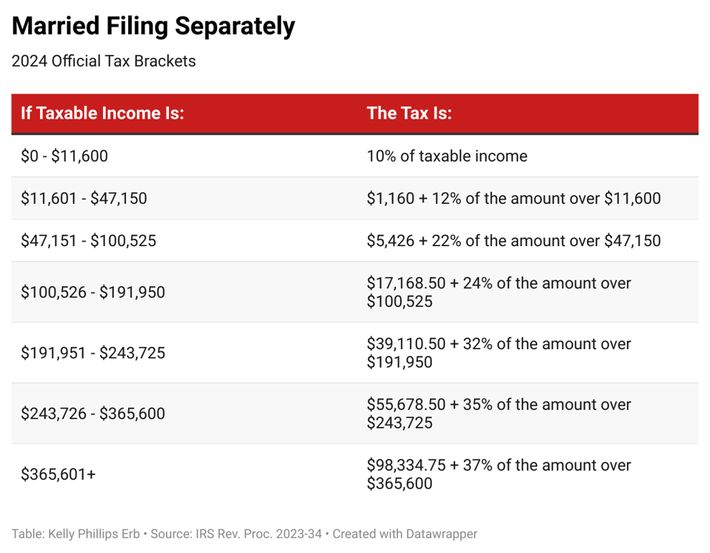

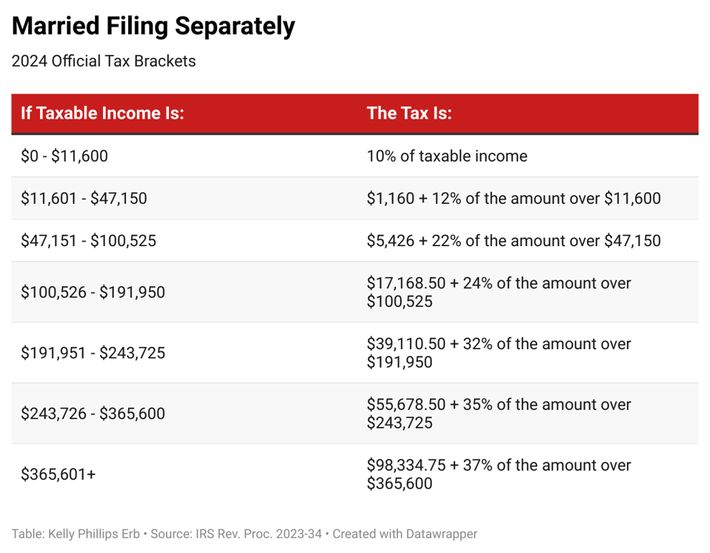

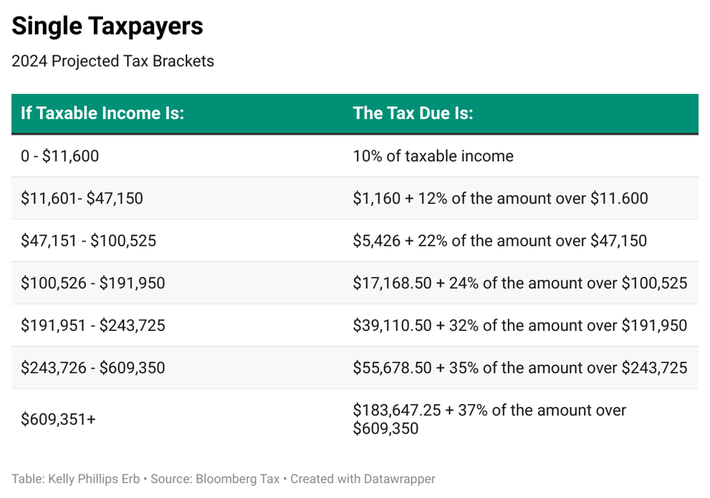

The increased standard deduction amounts can lower your taxable income, which in turn could lower your tax bill or increase your refund. Let’s look at an example for better understanding:

Example Scenario

Imagine you’re a single filer with an income of $50,000. Here’s a simplified look at how the standard deduction affects you:

- Gross Income: $50,000

- 2024 Standard Deduction: $14,600

- Taxable Income: $35,400

By using the standard deduction, you subtract $14,600 from your gross income, which significantly reduces your taxable income. This can lead to paying less in taxes or getting a larger refund!

Should You Itemize or Take the Standard Deduction?

One of the big questions when it comes to deductions is whether you should itemize or take the standard deduction. Generally, you should itemize if your total itemized deductions exceed the standard deduction amount. Otherwise, taking the standard deduction is simpler and more beneficial.

More Questions?

If you have more questions about the 2024 standard deduction and how it might affect your tax situation, it’s always a good idea to consult with a tax professional. They can provide personalized advice based on your specific financial circumstances.

For more detailed information straight from the IRS, you can check out their official publication on tax withholding and estimated tax for 2024 here.

In Conclusion…

The 2024 standard deduction increase is a positive change for taxpayers, helping to keep more money in your pocket. Whether you choose to take the standard deduction or itemize your deductions, staying informed and planning ahead can help you make the most of your tax return. Happy filing!