What is Form 1099-K and Why Should You Care?

Hello, dear readers! Let’s dive into the world of taxes and uncover the ins and outs of Form 1099-K. If you’ve been getting payments via credit cards or apps like PayPal, this article is for you!

Form 1099-K Explained in Simple Terms

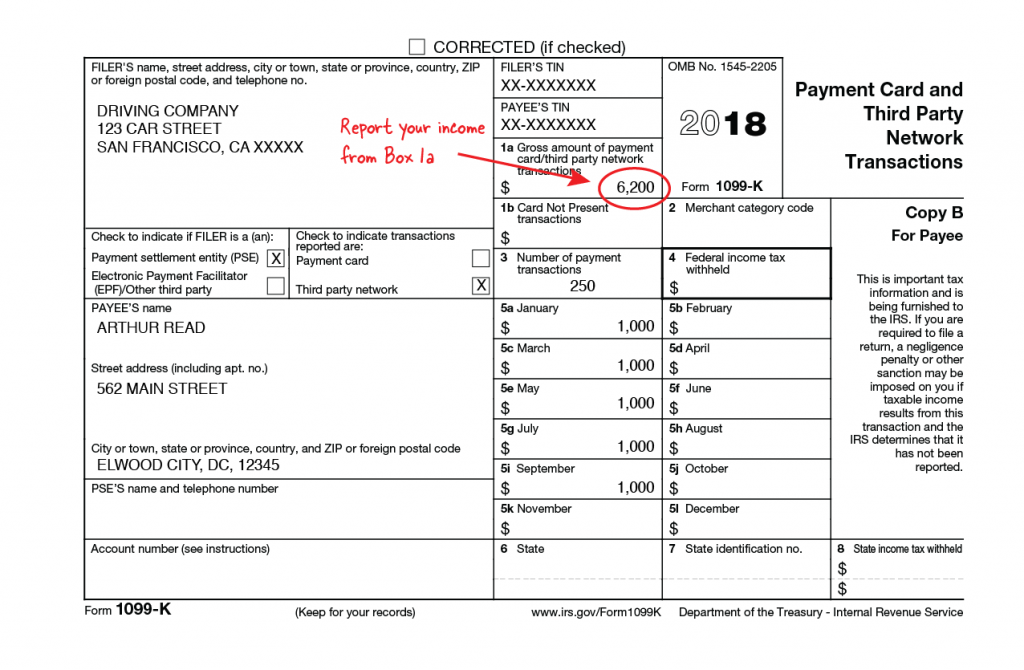

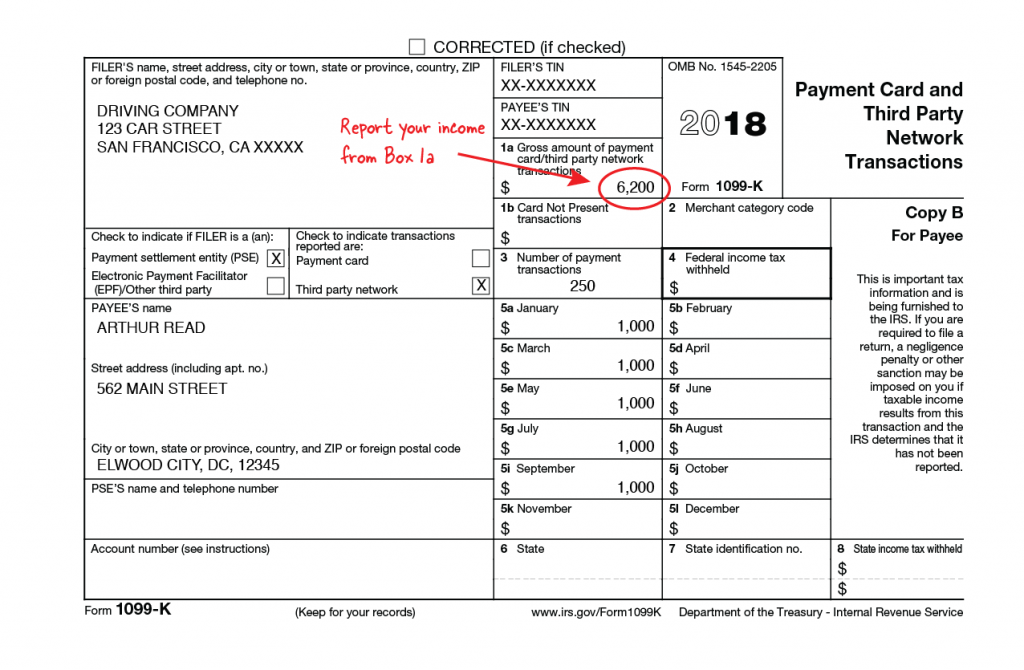

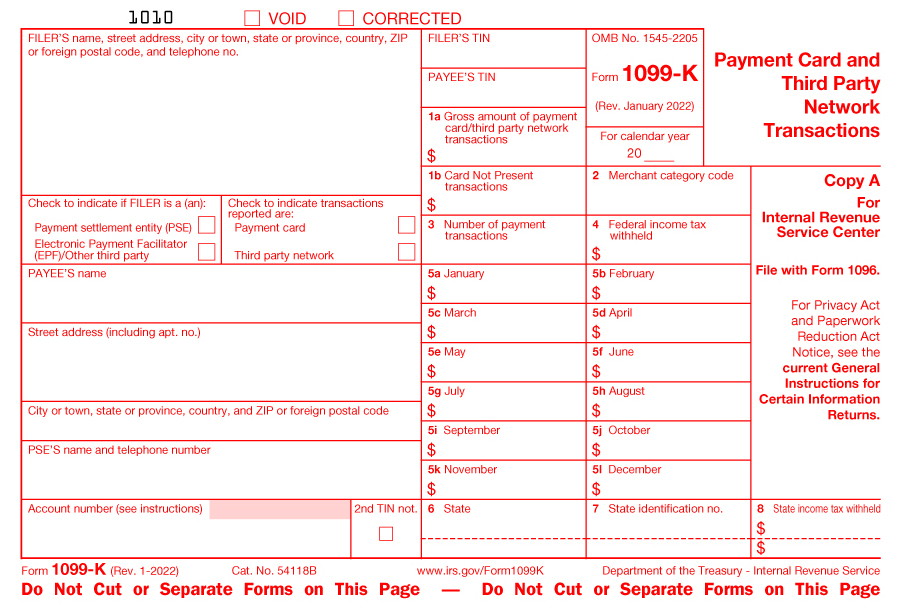

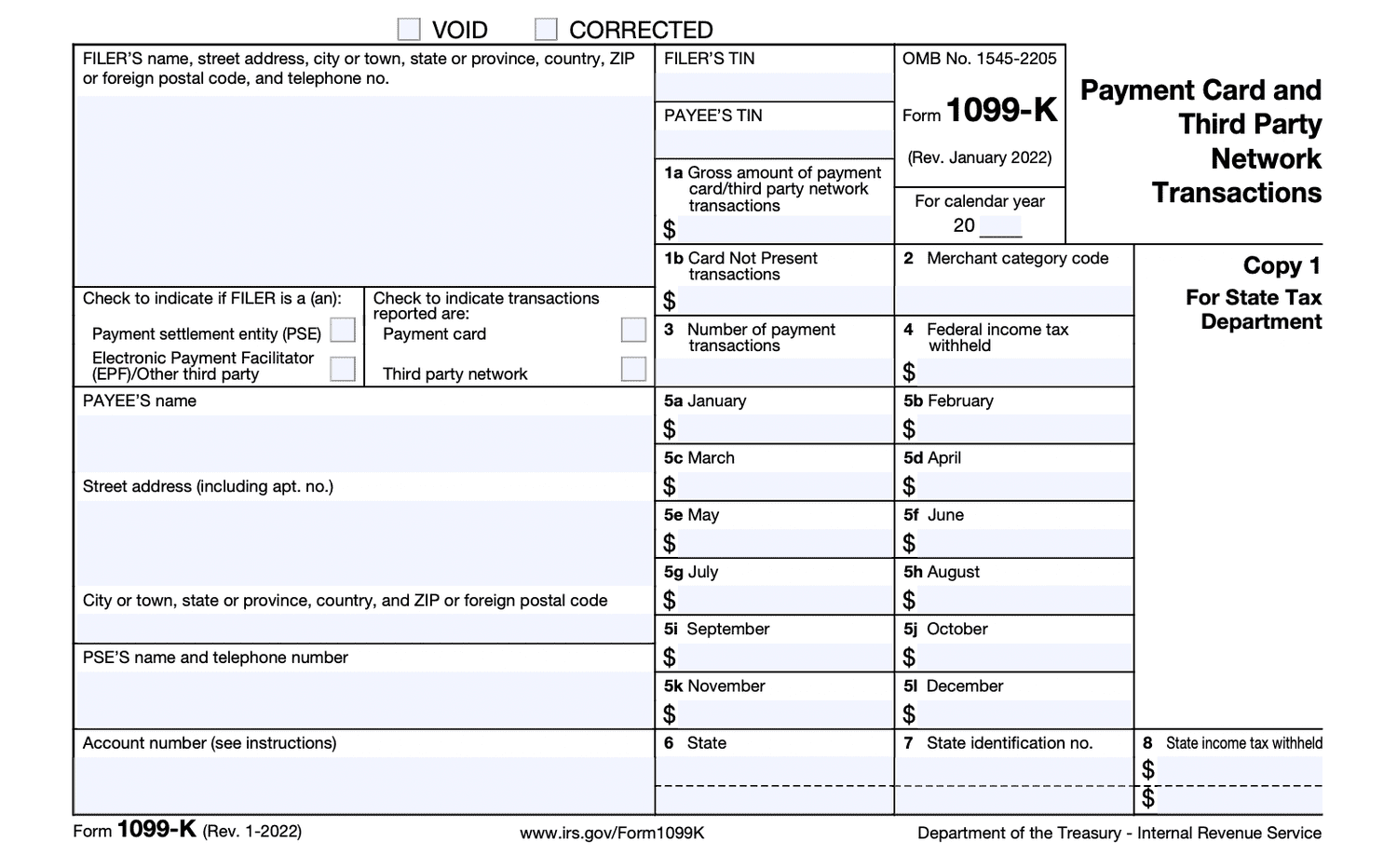

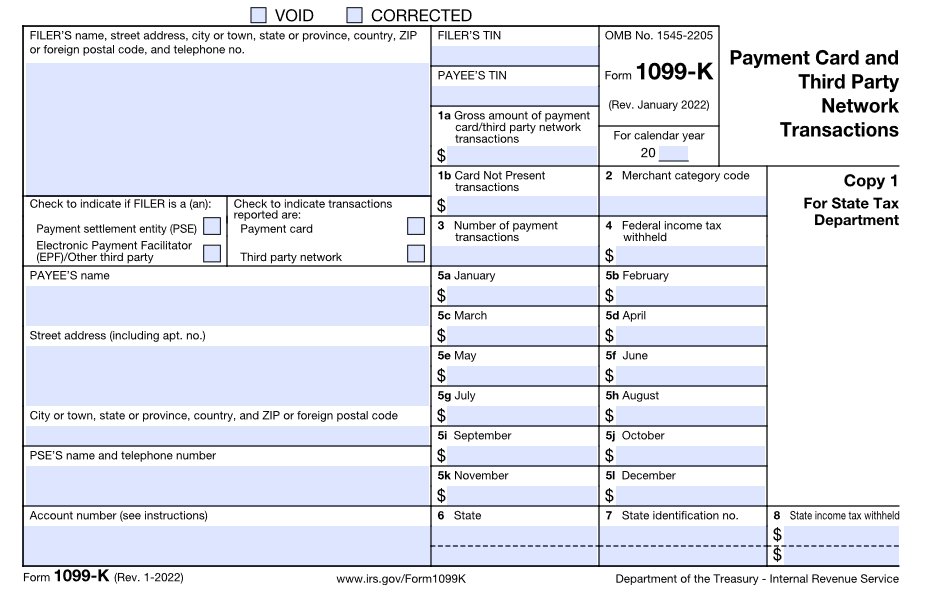

First things first, what exactly is Form 1099-K? It’s a document that reports the payments you get for goods or services during the year. This form is mainly issued by third-party payment processors like credit card companies and payment apps.

Who Sends and Receives Form 1099-K?

Payment card companies, payment apps, and online marketplaces must fill out Form 1099-K and send copies to the IRS and you by January 31. You’ll get this form if you take direct payments by credit or bank card for selling goods or providing services. Got payments over $20,000 from over 200 transactions? Expect this form to land in your mailbox!

Important: Family and Friends Payments

Good news! Payments received from family and friends for personal reasons should not be reported on Form 1099-K. So, money you get as birthday gifts or shared expenses won’t be your tax headache.

Reporting Income Using Form 1099-K

This part is super crucial! Use Form 1099-K alongside other records to calculate and report your taxable income when you file your tax return. Whether you get this form or not, remember to report all your income.

Tracking Your Transactions

Make sure all information on Form 1099-K is correct, including your taxpayer ID and the gross payment amount. Also, check your records for expenses you can deduct like fees, refunds, and shipping costs.

If There’s a Mistake

If you find incorrect information on your Form 1099-K, reach out to the issuer immediately. You might need a corrected form! But don’t let this delay your tax filings; note the errors as instructed and proceed.

Special Scenarios

There are times when Form 1099-K might report amounts that aren’t just yours. For instance, shared credit card terminals, business sales, or changes in business entities can complicate things. In such cases, proper record-keeping and communication with your payment settlement entity are key.

Common Questions and Concerns

Want to learn more? Check out these handy resources directly from the IRS:

Wrapping Up

Don’t let taxes stress you out! Understanding Form 1099-K can make the process smoother and stress-free. Keep your records straight, report all income, and make sure you’re in touch with issuers if errors pop up. Happy filing!