What is OASDI Tax and Why Should You Care?

If you’re scratching your head trying to figure out what OASDI tax is from your paycheck stub, you’re not alone! OASDI stands for Old Age, Survivors, and Disability Insurance, and it’s a key component of the U.S. Social Security system. Let’s dive into everything you need to know about this essential tax.

Breaking Down OASDI Tax

The OASDI tax contributes to the Social Security system, ensuring financial support for retirees, disabled individuals, and survivors. The rate currently stands at 6.2% for employees, matched by an additional 6.2% from employers. Self-employed? Then you’re looking at a 12.4% tax rate, but you can deduct half of this when you file your annual tax return.

How Much OASDI Tax Will I Pay?

For 2024, OASDI tax applies to income up to $168,600, which means the most you’ll pay is $10,453.20 if you’re employed or double that if you’re self-employed. This cap changes annually based on adjustments in Social Security regulations.

Got Multiple Jobs?

If you’re hustling with more than one job and your combined income exceeds the cap, you might overpay OASDI tax. Don’t worry—there’s a way to claim back any excess through your tax return. Make sure to report it correctly!

Where Does Your Money Go?

Understanding where your OASDI tax goes can make those payroll deductions a bit easier to swallow. Essentially, 85% of each dollar goes toward a fund for retirees and their families, with about 15% going to a fund for disabled Americans. A tiny fraction covers administrative costs.

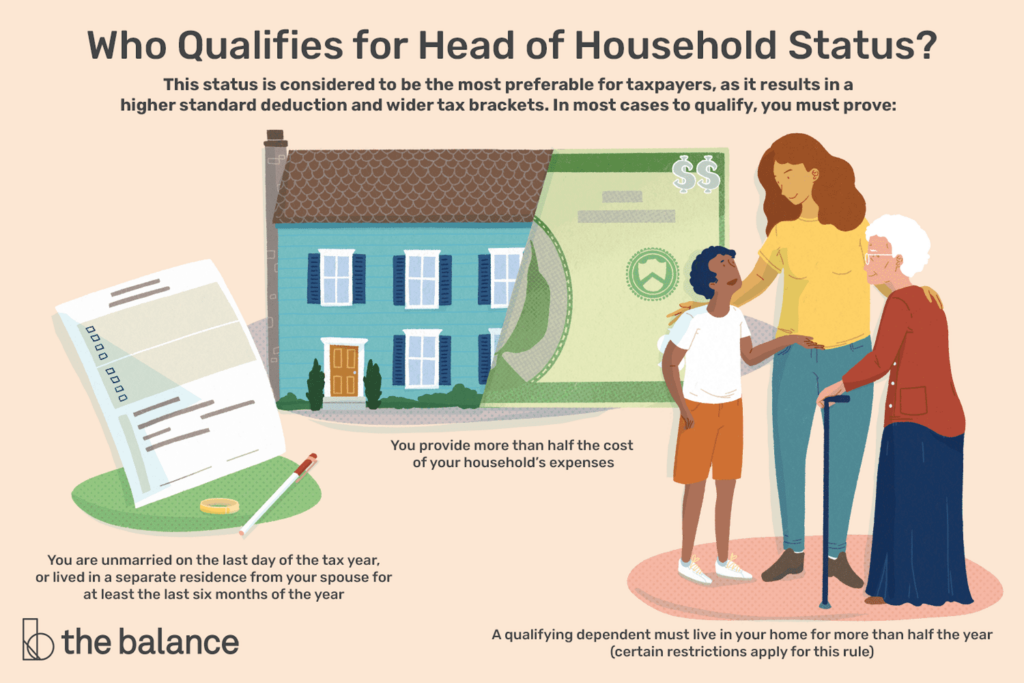

Is OASDI Tax Mandatory?

Great question! For most working Americans, the OASDI tax is mandatory. Exemptions are rare and include certain religious groups, academic workers or researchers without U.S. citizenship, and self-employed individuals earning less than $400 annually. You can learn more about exemptions and how to apply via this link.

Nonresident U.S. Citizens

If you’re a U.S. citizen but live abroad, you may still need to pay OASDI tax, depending on your country of residence and tax treaties. For instance, U.S treaties with Canada and the UK can prevent double taxation.

OASDI and Your Retirement Plan

While the OASDI tax provides critical retirement benefits, relying solely on Social Security might not cover all your expenses. On average, Social Security payouts are around $1,800 per month. So, it’s wise to have additional retirement savings like a 401(k) or IRA.

Planning for the Future

Despite the crucial role of OASDI tax, some experts argue that the current rate may need to be adjusted to keep the Social Security program solvent for future generations. There are discussions around potentially raising the rate to ensure long-term stability.

Bottom Line

The OASDI tax is a vital contribution to the Social Security program, ensuring support for millions of Americans. Whether employed or self-employed, paying into this system secures future benefits. However, it’s essential to have your own savings to complement these benefits for a comfortable retirement.

If you want more detailed information, you can visit this detailed guide on OASDI tax, which outlines everything you need to know.

Need Help with Your Finances?

Consider talking to a financial advisor to better understand your taxes and retirement strategy. You can find one in your area through SmartAsset’s free tool here.