Everything You Need to Know About the 2023 Standard Deduction!

Hey there, tax filers! 📝 Looking for the lowdown on the 2023 standard deduction? You’re in the right place. Whether you’re a seasoned pro or a newbie to tax filing, we’ve got all the juicy details that will make this tax season a breeze.

What is the Standard Deduction?

First things first, the standard deduction is a set amount that reduces your taxable income. Think of it as a tax break that can save you a chunk of change without having to itemize every single deduction. Sounds great, right? 🤩

2023 Standard Deduction Amounts

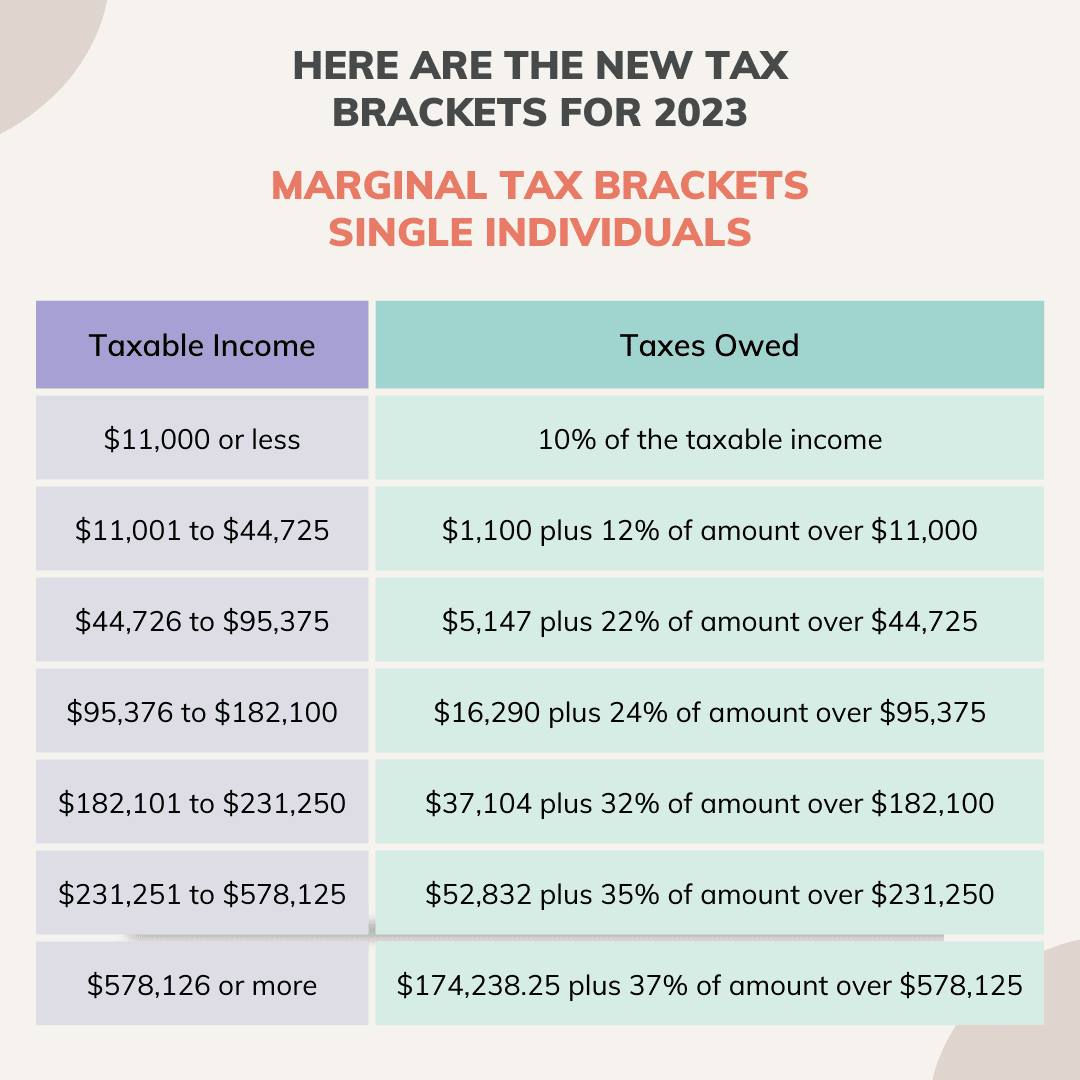

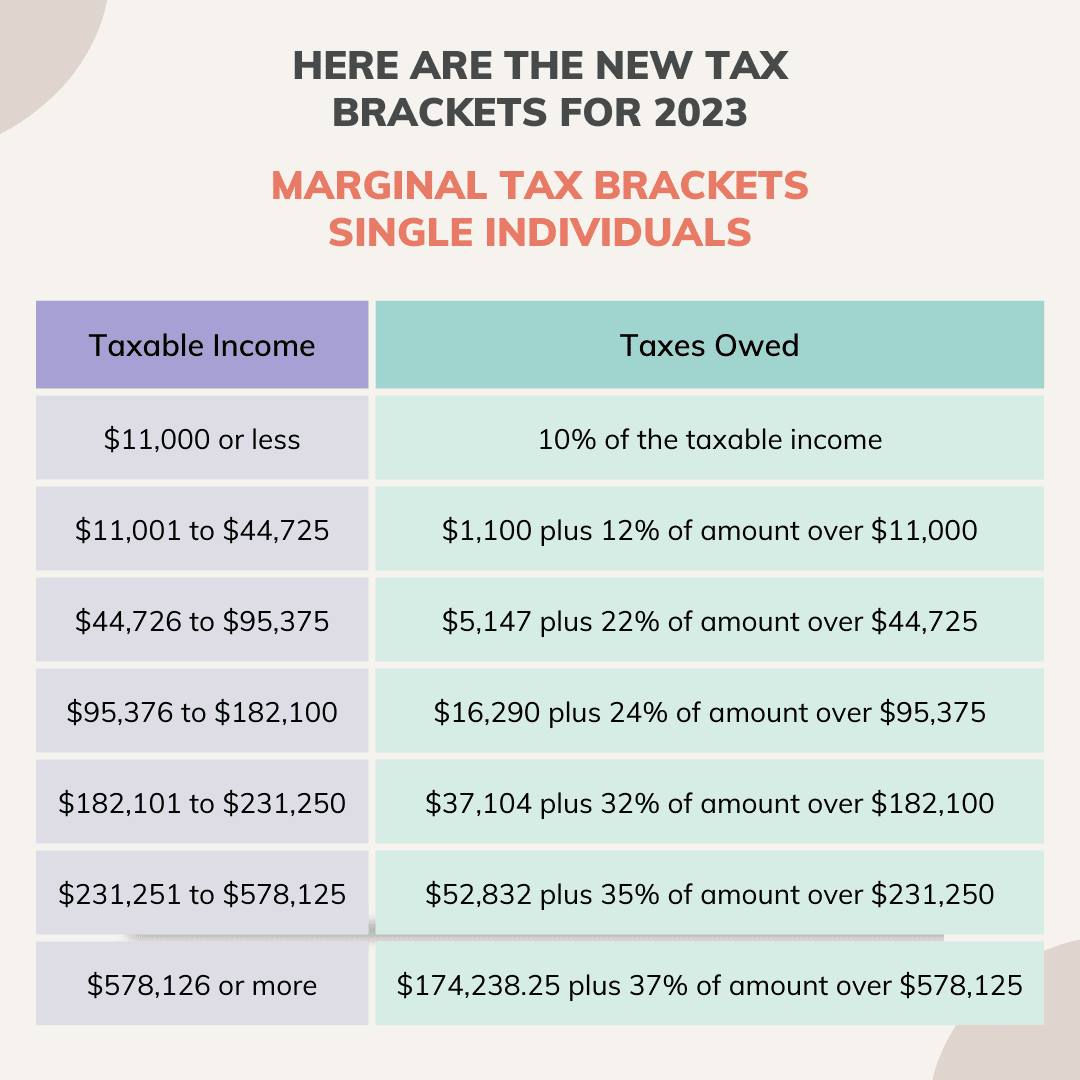

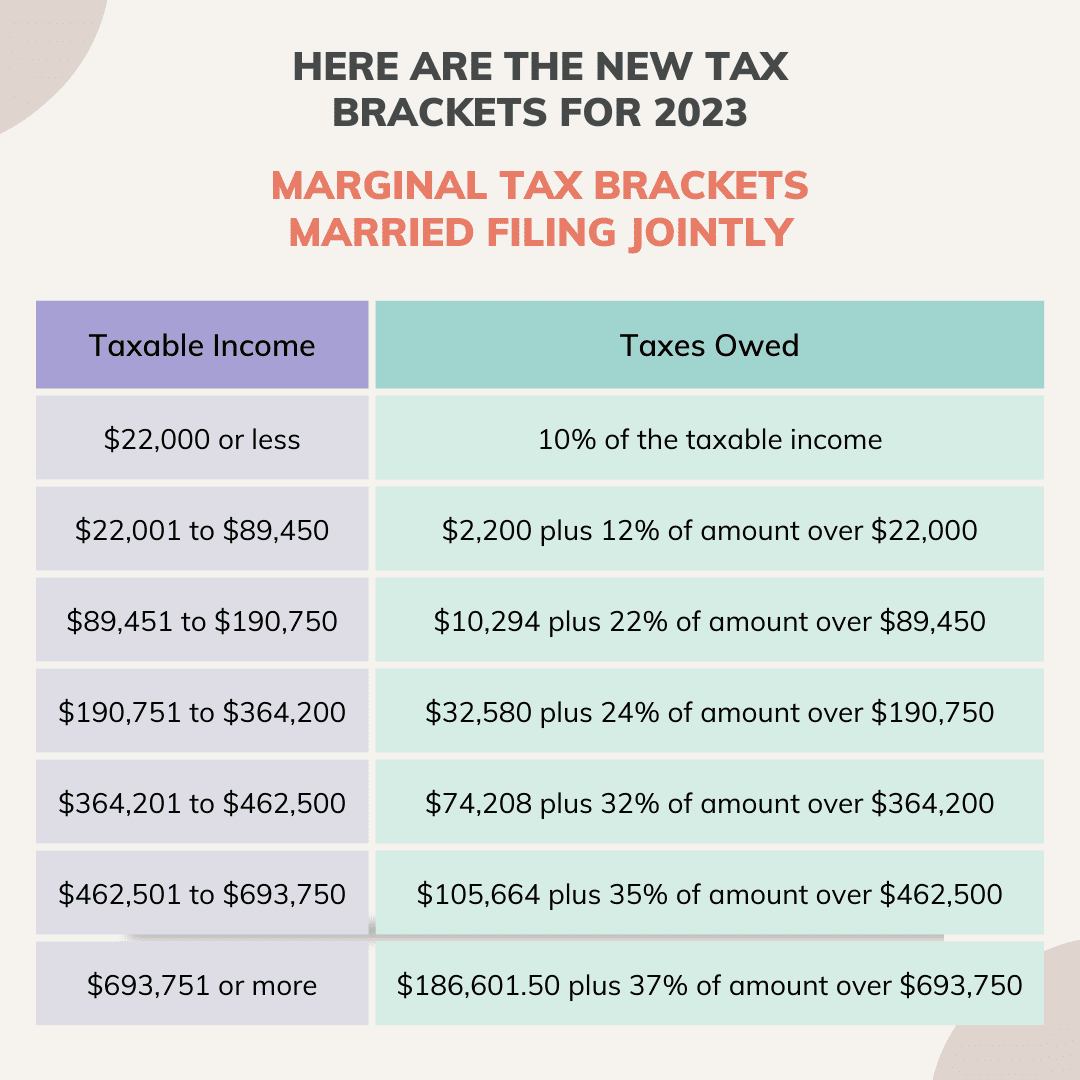

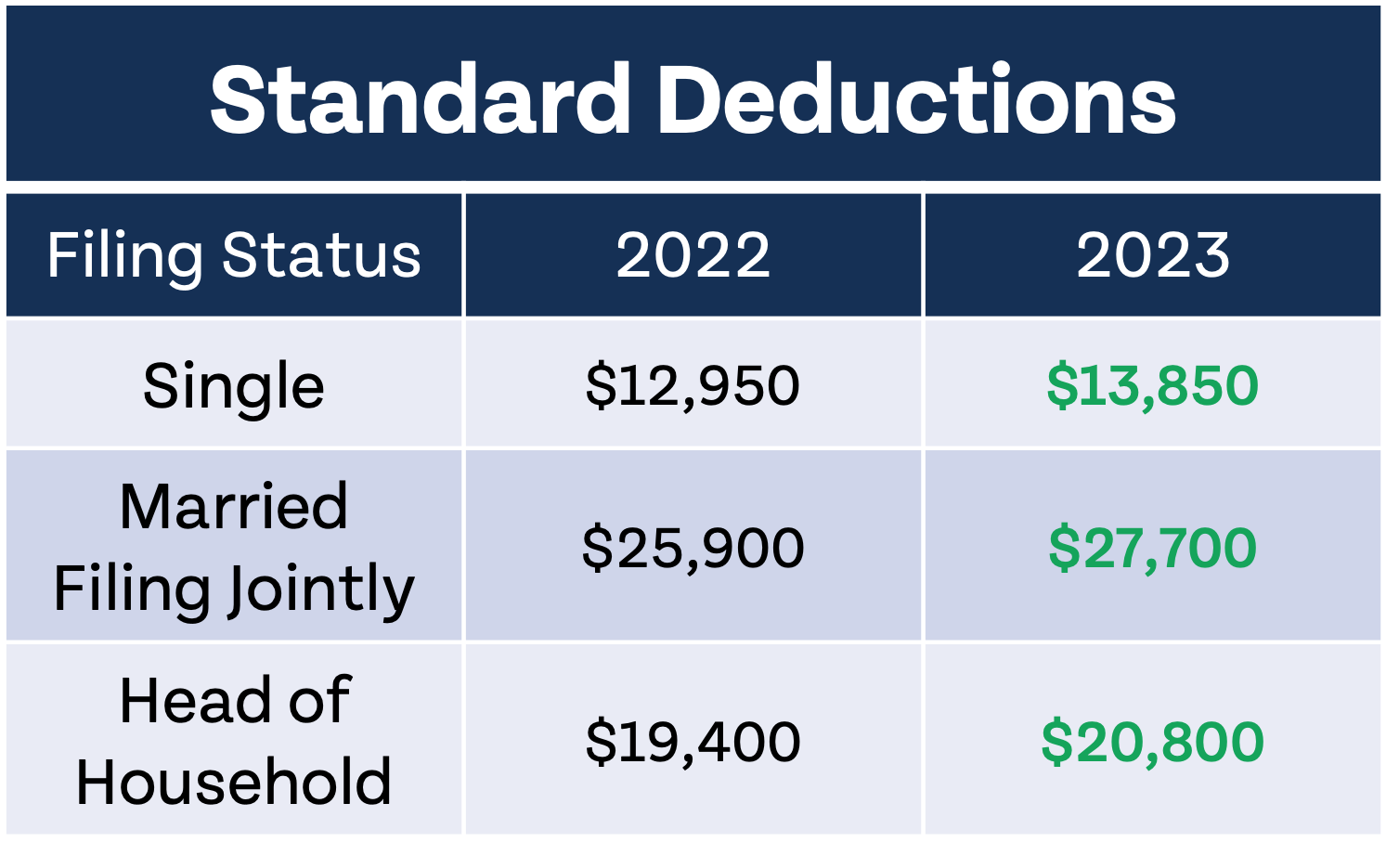

Let’s cut to the chase. For the tax year 2023, here are the standard deduction amounts:

- Single and Married Filing Separately: $13,850

- Married Filing Jointly and Surviving Spouses: $27,700

- Head of Household: $20,800

These amounts are slightly up from previous years, thanks to adjustments for inflation. 💸 Want to crunch the numbers? Check out the official IRS page for more info: IRS Standard Deduction 2023.

Who Gets Higher Standard Deductions?

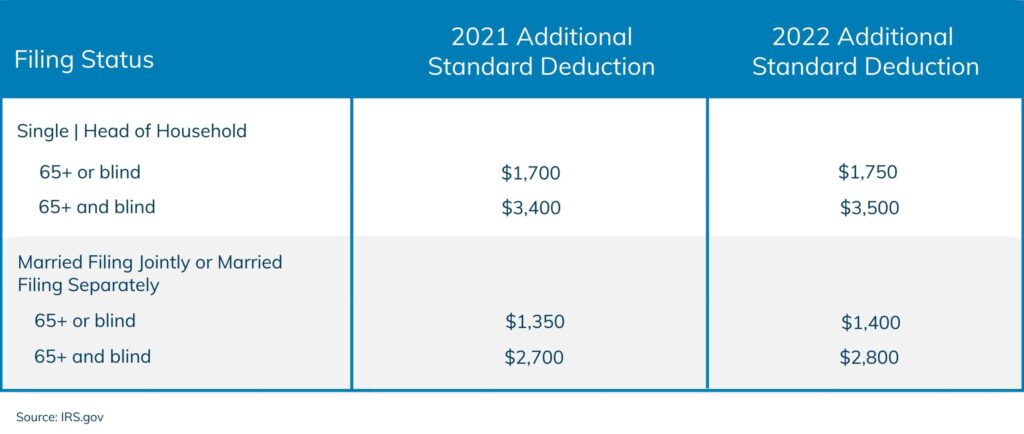

If you’re 65 or older or if you’re blind, you’re in luck! You qualify for an additional deduction. Here’s how much extra you get:

- Single or Head of Household: + $1,850

- Married Filing Jointly or Separately: + $1,500 per qualifying individual

That means if you’re 65 and both you and your spouse are filing jointly, you could snag an extra $3,000 on top of your standard deduction! 🙌

When to Choose the Standard Deduction?

Most people find the standard deduction to be the easier and more beneficial choice. But, it might not always be the best route for everyone. Here’s when you should consider it:

- You don’t have many itemized deductions like mortgage interest and medical expenses.

- You want a quick and straightforward filing process.

If your itemized deductions add up to more than the standard deduction, itemizing might be the way to go. Always worth running the numbers both ways! 🤓

Important Links and Tools

Ready to dive deeper? Here are some essential links and tools to help you breeze through your tax filing:

- NerdWallet Standard Deduction Guide – A handy guide with detailed info and calculators.

- Extra Standard Deduction for 65 and Older – Learn more about extra deductions for seniors.

So there you have it, folks! All the vital info you need about the 2023 standard deduction. Got more questions or tips? Drop them in the comments below! 🗨️

Make this tax season your easiest one yet! 🚀