Everything You Need to Know About the 16th Amendment

Hey there, curious minds! 🧐 Are you ready to dive into the fascinating world of the 16th Amendment? Whether you’re a history buff or just someone looking to understand how our tax system got its roots, you’re in the right place! Let’s break it down together in a fun and engaging way. Ready? Let’s go!

What Is the 16th Amendment?

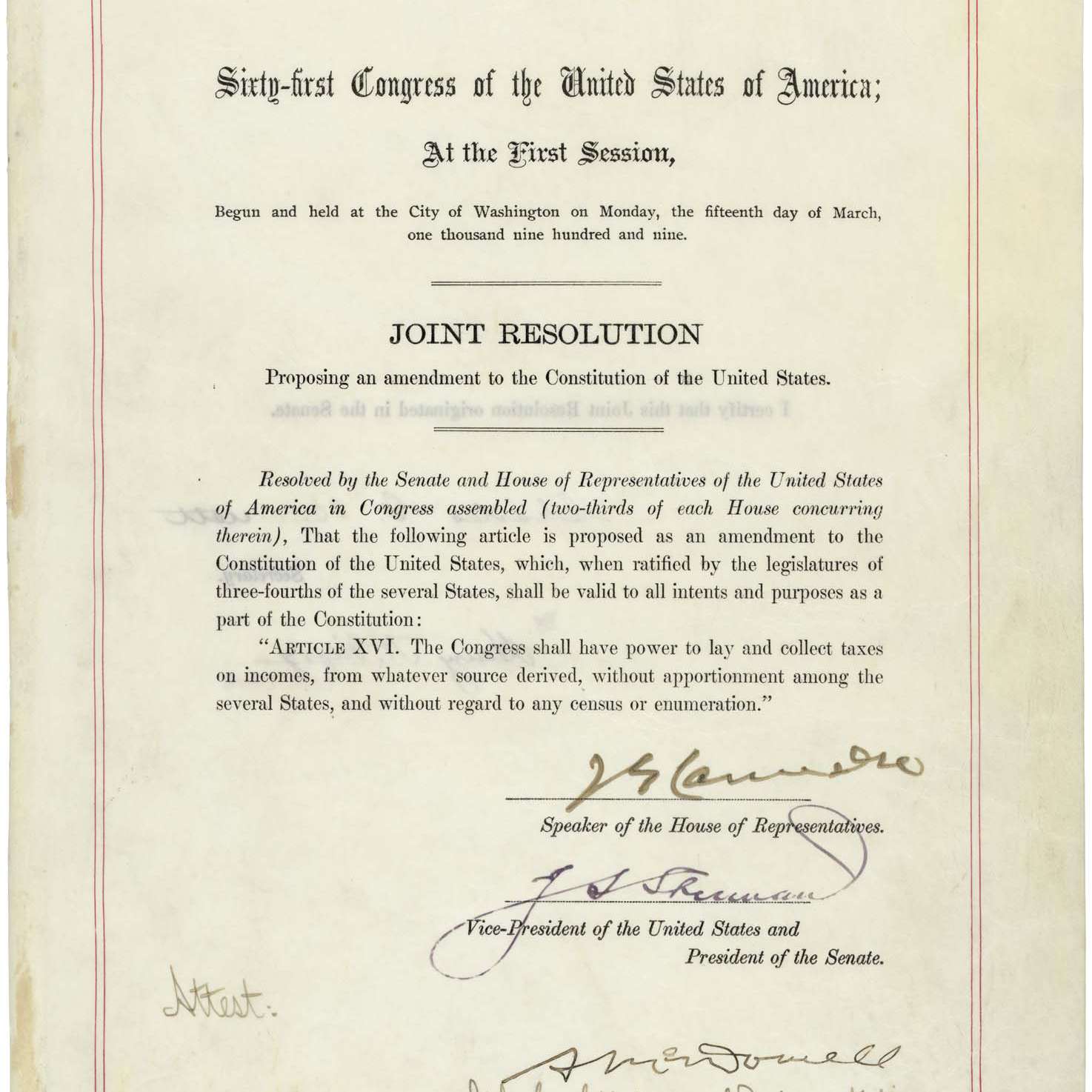

In simple terms, the 16th Amendment to the U.S. Constitution gives Congress the power to collect income taxes from all Americans. That’s right! It’s the amendment that made paying taxes a thing. Ratified on February 3, 1913, this amendment allows the federal government to tax incomes from any source without splitting it up among the states or considering the census. Sounds pretty important, right? 🎓

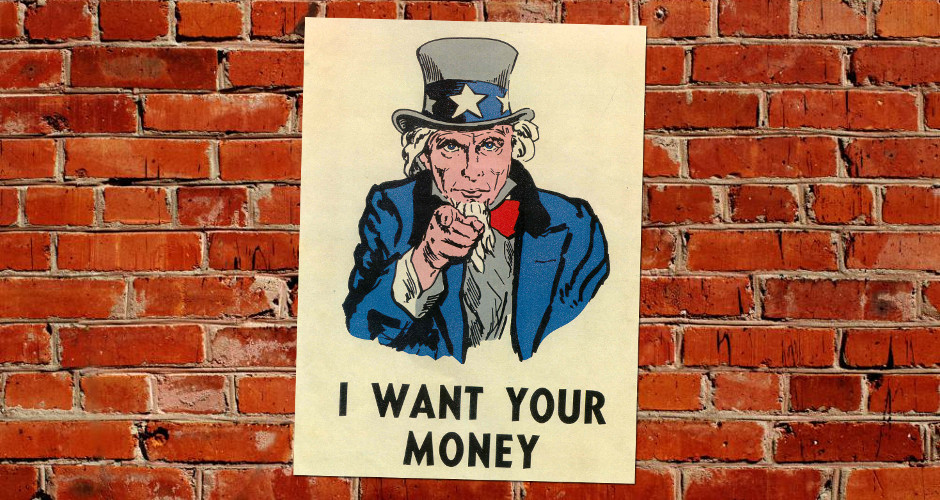

Why Was the 16th Amendment Necessary?

Before the 16th Amendment, the U.S. government primarily relied on tariffs and excise taxes for revenue. These taxes were seen as unfair because they placed a heavier burden on the middle and lower classes. To create a more equitable system, a national income tax was proposed. But hold on! The Supreme Court struck down an earlier attempt at an income tax in 1895 (Pollock v. Farmers’ Loan & Trust Co.), calling it unconstitutional. Thus, the 16th Amendment was born to solve this problem once and for all!

The Journey to Ratification

Think about the early 1900s, a time filled with social and political change. 🌍 The Progressive Era was in full swing, and reform was the name of the game. President William H. Taft proposed the idea of a federal income tax, and it quickly gained traction, especially among those in the South and West who disliked the tariffs that were causing prices to skyrocket. After plenty of debates and pushback, the amendment was finally ratified when Delaware, Wyoming, and New Mexico gave their approval in early 1913.

What’s the Big Deal?

So, why should you care about the 16th Amendment today? Well, it’s the foundation of the federal income tax system we all participate in. Without it, Congress wouldn’t have the power to levy income taxes, making it incredibly difficult for the government to fund essential services like defense, infrastructure, and education. In 2022, for example, the IRS collected nearly $5 trillion in gross taxes, with over half coming from individual, estate, and trust income taxes. Wow, right? 💸

Limitations of the 16th Amendment

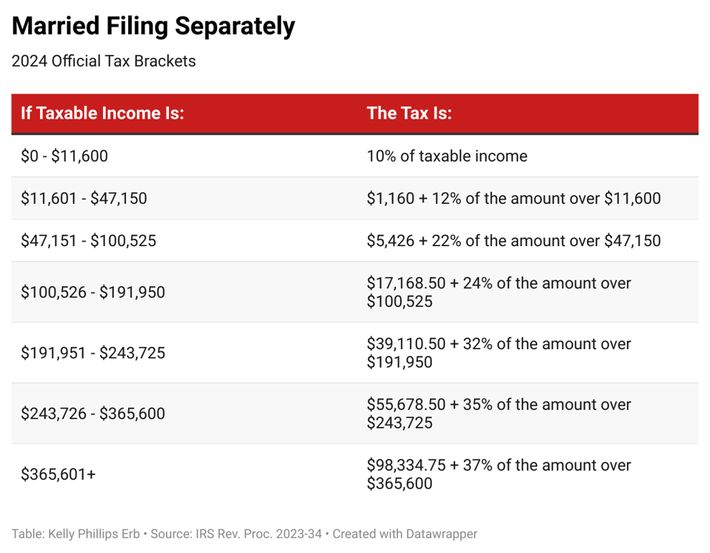

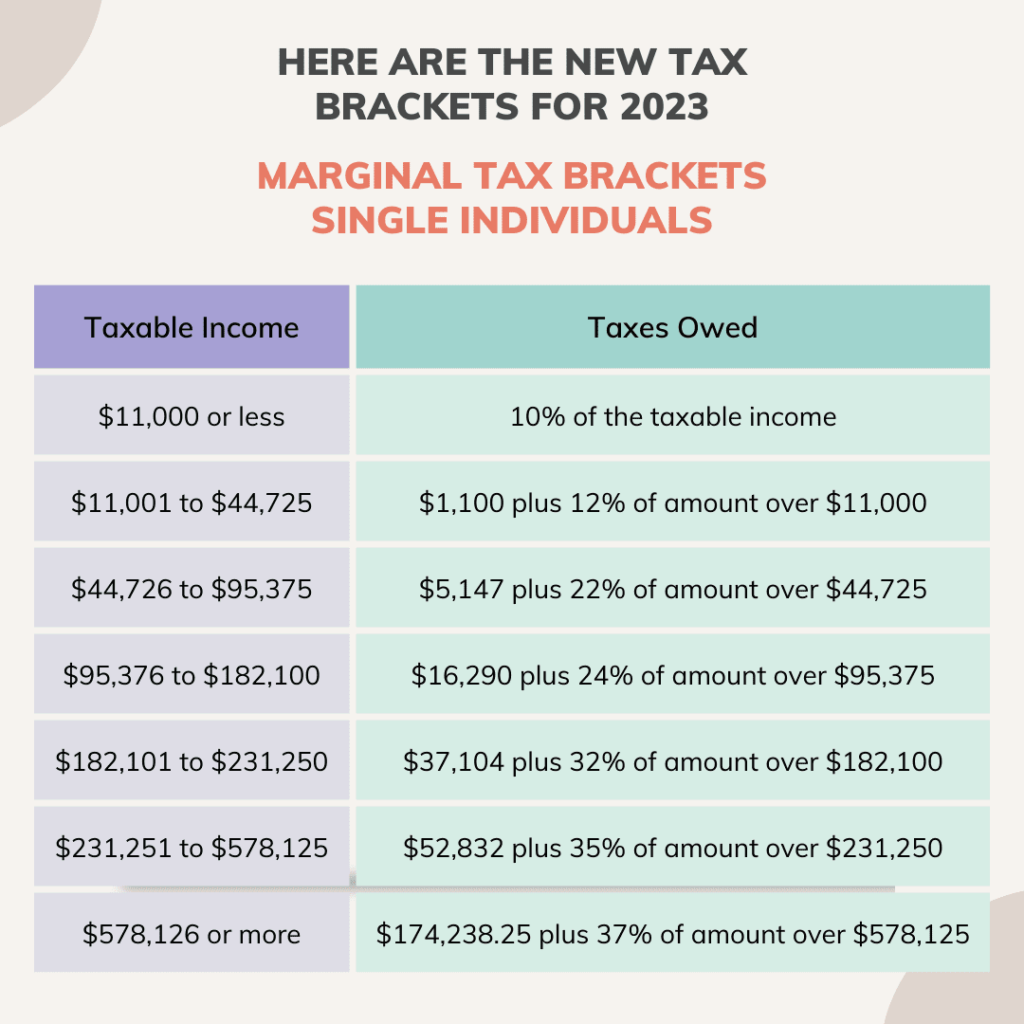

However, it’s not all-powerful. The 16th Amendment doesn’t give the federal government the right to tax state and local entities. Plus, while the amendment allows Congress to collect income taxes, it doesn’t dictate where that money should be spent. Congress still has to pass specific laws to outline tax rates, deductions, and expenditure plans.

Fun Fact Time!

Did you know? The first permanent federal income tax was established the same year the amendment was ratified. In 1913, the tax schedule ranged from 1% on the first $20,000 of income to 6% on income exceeding $500,000. The government raised a total of $28.3 million that year! And nope, those amounts aren’t adjusted for inflation.

Current Debates and Implications

The 16th Amendment still sparks debates even today. Some argue for expanding the government’s power to levy taxes, especially in light of frequent budget deficits. Others advocate for limited governmental power. Regardless, the amendment remains the bedrock of any discussion on tax policy.

The Bottom Line

The 16th Amendment forever changed how the U.S. government collects revenue, paving the way for the modern income tax system. It allowed for a fairer distribution of tax burdens and provided the government with a steady revenue stream to fund essential services. So next time you’re filing your taxes, you know who to thank! 😉

Want to dive deeper? Check out the full text of the amendment on Reagan Library’s official page or learn more about the implications on Investopedia.