What is EFTPS and How Can It Help You Manage Your Federal Taxes?

Hey there! Are you tired of juggling your federal tax payments and looking for a more convenient way to handle them? Well, you’re in luck! Today, we’re diving into the world of EFTPS – the Electronic Federal Tax Payment System. This nifty service offered by the U.S. Department of Treasury could be just the solution you’re searching for. Ready to learn more? Let’s get started!

What is EFTPS?

EFTPS stands for Electronic Federal Tax Payment System. It’s a free service provided by the U.S. Department of Treasury that allows you to pay your federal taxes electronically. Whether you’re an individual or a business owner, EFTPS offers a secure, convenient, and accurate way to manage your tax payments from the comfort of your home or office.

Why Should You Use EFTPS?

Here are some fantastic reasons to start using EFTPS today:

1. Security You Can Count On

Your payments are protected with multiple layers of security, including your Taxpayer Identification Number (EIN or SSN), Personal Identification Number (PIN), and an Internet Password. This ensures your transactions are safe and secure.

2. Convenience at Your Fingertips

With EFTPS, you can schedule payments up to 365 days in advance, track them with email notifications, and view 15 months of payment history. Plus, you can easily change or cancel scheduled payments if needed. Talk about convenience!

3. Accuracy You Can Depend On

EFTPS provides an immediate acknowledgment of your payment, and it will also show up on your bank statement. This gives you peace of mind knowing that your payments have been made accurately.

How to Enroll in EFTPS

Interested in signing up? Here’s a quick guide on how to enroll:

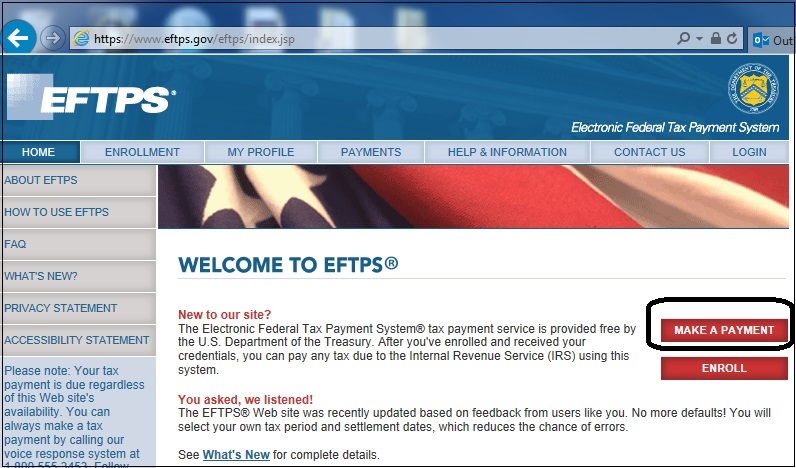

- Visit the EFTPS Website and click on “Enrollment.”

- Follow the steps to provide your information, which will be validated with the IRS.

- After validation, you’ll receive a Personal Identification Number (PIN) via U.S. Mail within five to seven business days.

- Once you have your PIN, you can log in and start using the service!

Need Help with Multifactor Authentication (MFA)?

As of October 19, 2023, EFTPS requires Multifactor Authentication (MFA) for system access to comply with Executive Order 14028. You can authenticate via Login.gov or ID.me. For assistance with MFA, visit Login.gov or ID.me, or call EFTPS customer service at 1.800.555.4477.

Additional Resources

For more detailed information, check out these resources:

Conclusion

In a nutshell, EFTPS is a powerful tool that can simplify your federal tax payments, making them secure, convenient, and accurate. Whether you’re an individual taxpayer or a business owner, EFTPS offers features that can take the hassle out of managing your taxes. So why wait? Enroll today and take control of your federal tax payments with ease!

Have you used EFTPS before? Share your experience in the comments below. And if you have any questions, feel free to ask. We’re here to help!